A journal keeps a historical account of all recordable. Keep track of every amount you spend on your business and every amount you take in as sales.

A Record Book Used To Keep Track Of All Transactions, A customer who owes money is called a debtor. Maintain and update financial records. A journal keeps a historical account of all recordable transactions with which.

The stock ledger is a record that keeps track of the stock transactions for your corporation. You may have to keep separate journals for transactions that occur frequently. We build a personal pro le page which What is the difference between accounting and bookkeeping?

Recording Accounting Transactions Overview and Types

A bookkeeper is primarily responsible to record and track a company�s financial transactions which include, purchases, sales and expenses. “capture” is the most difficult step and it�s the most important part of the process. Each business uses the kind of journal that best fits the needs of that Keep track of every amount you spend on your business and every amount you take in as sales. Records are a legal requirement. They can serve as an accurate record of your financial situation to help you manage your money more efficiently.

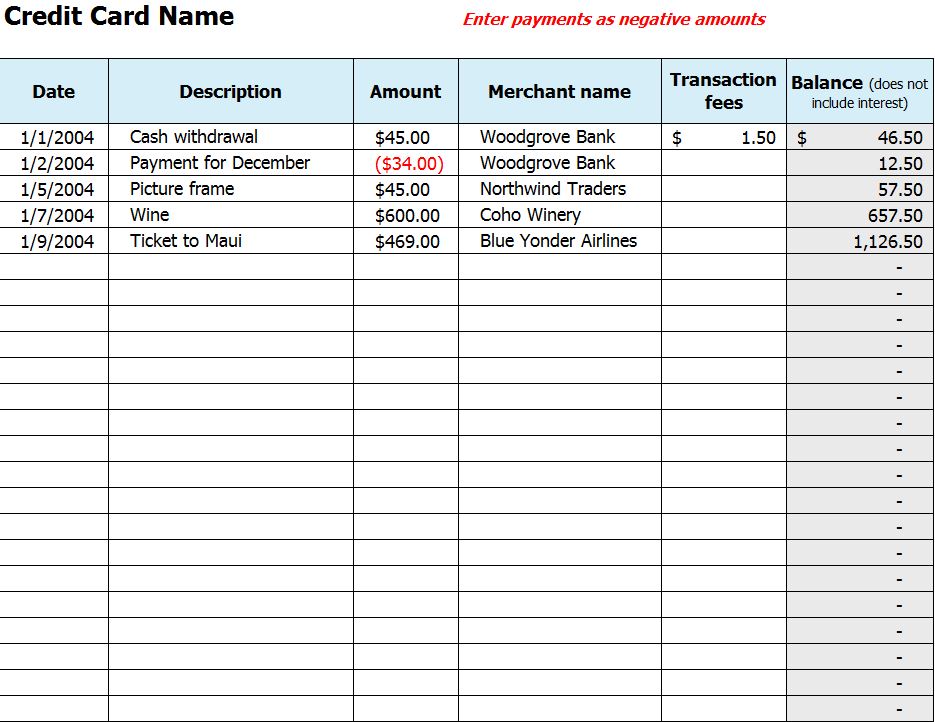

Sample Check Register Template 10+ Free Sample, Example, A journal is the first place information is entered into the accounting system. There are three templates to choose from for 300, 700 or 1,000 items. There is one entry per transaction and most entries record either incoming or outgoing funds. A journal is often referred to as the book of original entry because it is the place the information.

Single Entry Bookkeeping · HubPointWeb, A check register is the little book in which you record your deposits and withdrawals/payments (which could be by check, debit card, autopay, eft, or online transaction, and probably some i didn’t think of) for your checking account. A journal is often referred to as the book of original entry because it is the place the information originally enters into.

Credit Card Use Log Credit Card Use Template, Essentially, it comprises anything that is part of a business transaction. “capture” is the most difficult step and it�s the most important part of the process. Accountants use special forms called journals to keep track of their business transactions. It helps record regular transactions so that you can better understand your cash flow. How to keep your books 1.

Single Entry Bookkeeping, Another way of keeping records is by using a computer. Records management (rm), also known as records and information management (rim), is an organizational function responsible for the creation and maintenance of a system to deal with records throughout a company’s lifecycle.rm includes everything from the creation of a record to its disposal. You may have to keep separate journals.

8+ Petty Cash Log Templates Excel Templates, Only customers who buy goods or services on credit are included here. These transactions are first recorded as general ledger, which are later used while preparing a balance sheet. It helps record regular transactions so that you can better understand your cash flow. With a journal that combines sales and cash receipts, you record all sales (cash and credit) and.

Daily Logbook/Record Keeping Page 2 Business, A journal is the first place information is entered into the accounting system. A check register is the little book in which you record your deposits and withdrawals/payments (which could be by check, debit card, autopay, eft, or online transaction, and probably some i didn’t think of) for your checking account. Recording business transactions is the process of entering business.

Adams SC1182 7 5/8" x 11" 2Part Carbonless Spiral Bound, Accountants use special forms called journals to keep track of their business transactions. Accountants use special forms called journals to keep track of their business transactions. Another way of keeping records is by using a computer. These transactions are first recorded as general ledger, which are later used while preparing a balance sheet. The process of recording transactions.

Excel Checkbook Register Free Checkbook Register, There are three templates to choose from for 300, 700 or 1,000 items. The process of recording transactions. Transactions are recorded in a “cash book”—a journal with columns that organize transactions details like date, description and whether it’s an. Whether simple or complex, a record keeping system must be easy to use and provide adequate storage and retrieval of records..

Single Entry Bookkeeping, There are three templates to choose from for 300, 700 or 1,000 items. The purpose of storing purchase invoices in this way is to document expenses and profits and record any changes in your materials. Accountants use special forms called journals to keep track of their business transactions. In the single entry system single entry system the single entry system.

![]()

8 Sample Expense Tracking Templates to Download Sample, Take care to keep personal and business expenditures separate even if you always pay your business back when you pay personal expenses out of that account. This is only one part of the total amount of corporate records you must keep, and should be maintained in the corporate records book. The details depend on the type of business you own,.

Monthly Bookkeeping charlotte clergy coalition, How to keep your books 1. Another way of keeping records is by using a computer. A journal is a book where you record each business transaction shown on your supporting documents. Essentially, it comprises anything that is part of a business transaction. A bookkeeper is primarily responsible to record and track a company�s financial transactions which include, purchases, sales.

Used car record book (police book) 8360, “capture” is the most difficult step and it�s the most important part of the process. Accountants use special forms called journals to keep track of their business transactions. Take care to keep personal and business expenditures separate even if you always pay your business back when you pay personal expenses out of that account. Check registers help you to keep.

Recording Accounting Transactions Overview and Types, Your accounting books provide a place for you to review your business’s income and expenses and see where you stand financially. The details depend on the type of business you own, but it can include tasks like settling accounts receivable and bank statements, recording financial transactions, invoicing, billing. The best way to use this complex product sales record sheet is.

Simple Cash Book Format Design for Quick Money Tracking, Keep track of every amount you spend on your business and every amount you take in as sales. A ‘receipt’ is an umbrella term for different kinds of source documents or electronic references that record transactions, including invoices, purchase invoices, note payables, credit card slips, and salary rosters. Recording business transactions is the process of entering business events into the.

Petty Cash Log Template Download in MS Word Free Log, The cash book and payment receipt record book this is one of the types of simple farm records a good farmer should take note, cash book, and payment receipt record is a farm record book of all financial transactions, both the income and expenditure, of the farm. How to keep your books 1. Recording business transactions is the process of.

2012 How to Track Sales Taxes Using Big EZ Bookkeeping, A ledger is a book that contains the totals from all of your journals. In business, you must keep records of your transactions in your books. Records help an entrepreneur keep track of business transactions, aid in the filing of taxes, compile final accounts and act as a future reference. A journal is a book where you record each business.

General Journal Download PDF Accounting Form, Keep track of every amount you spend on your business and every amount you take in as sales. Records are a legal requirement. To simplify your bookkeeping, we recommend a combined sales and cash receipts journal. The first section of this page explains how to use this template. Credit records, debtors records, production records, cash book, purchases records, stock records.

Petty Cash Record Sheet Template Word Document Templates, With a journal that combines sales and cash receipts, you record all sales (cash and credit) and all cash receipts, including collection of accounts receivable, in one journal, which your software should be able to accommodate. This is a subsidiary ledger used to keep track of how much money customers owe a business. We support services for buying and selling.

Adams Monthly Bookkeeping Record LD Products, And finally, a column showing the transactions received is a must in this product sales record sheet. When you use the paper based method of book keeping you must make sure you keep all your records in a legible and well organised manner. Most importantly, the record keeping system you choose must be suited to your particular business needs. A.

Recording Transactions into General Journal YouTube, Maintain and update financial records. However, most companies wish to create a more permanent record by recording transactions in a journal. A customer who owes money is called a debtor. Records management (rm), also known as records and information management (rim), is an organizational function responsible for the creation and maintenance of a system to deal with records throughout a.

FREE 9+ Sample Checkbook Register Templates in PDF MS, The best way to use this complex product sales record sheet is to use a template for it. The cash book and payment receipt record book this is one of the types of simple farm records a good farmer should take note, cash book, and payment receipt record is a farm record book of all financial transactions, both the income.

Excel Accounting and Bookkeeping (Template Included, A journal keeps a historical account of all recordable transactions with which. Records management (rm), also known as records and information management (rim), is an organizational function responsible for the creation and maintenance of a system to deal with records throughout a company’s lifecycle.rm includes everything from the creation of a record to its disposal. This is a subsidiary ledger.

Pharmacy Reports Prescription Book, Dangerous Drug Use, Journals store financial transaction information ultimately derived from source documents. There are three templates to choose from for 300, 700 or 1,000 items. The stock ledger is a record that keeps track of the stock transactions for your corporation. Only customers who buy goods or services on credit are included here. Bookkeeping involves working with numbers.

Sheep Farm Records Planner Navy and Blush Floral Farm, Each business uses the kind of journal that best fits the needs of that Essentially, it comprises anything that is part of a business transaction. Understand how to maintain records. Recording business transactions is the process of entering business events into the accounting system, which is more common and very automated now, or accounting books. Accountants follow a three steps.

Record Vital Sign Template, How to keep your books 1. They can serve as an accurate record of your financial situation to help you manage your money more efficiently. There is one entry per transaction and most entries record either incoming or outgoing funds. The project is based on a book database system pertaining to various needs of the user. Records management (rm), also.