The ultimate guide to post merger (m&a) integration process. To put it mildly, mergers and acquisitions revolve around a plethora of moving parts.

Acquisition Integration Books, Explain the effect of merger on earnings per share and market price per share. Clients and subscribers may log in here. Summarize acquisition strategy and process.

However, it is unclear what kind of growth the client is pursuing. Summarize acquisition strategy and process. Strategies of merger and acquisition • there is an important need to assess the market by deciding the growth factors through future market opportunities. Academy of management journal, 51 (4), 744 767.

Lessons from 1000 Deals Pritchett LP

Accounting for acquisitions chapter 15. Author and renowned m&a expert scott whitaker presents the best practices with pragmatic insights and proactive strategies to inform your thinking toward crafting the optimal. The acquisition integration playbook includes the following nine sections: In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Describe the risk of the acquisition. She is the author of done deal:

![[PDF] Mergers & Acquisitions Integration Handbook Helping [PDF] Mergers & Acquisitions Integration Handbook Helping](https://i2.wp.com/www.perlego.com/_next/image?url=https:%2F%2Fwww.perlego.com%2Fbooks%2FRM_Books%2Fwiley_hlvwyirv%2F9781118233429_500_750.jpg&w=1440&q=75)

[PDF] Mergers & Acquisitions Integration Handbook Helping, It also covers personal computers and how laptop or notebook computers work with data acquisition systems. Explain the effect of merger on earnings per share and market price per share. Benefits and advantages of playbook utilization must be obvious to users and stakeholders. Achieving connection, fulfillment and success at work. Intermediate goals as mediators of integration decisions and acquisition performance.

M&A PostAcquisition Integration Management Strategic, Use capital budgeting techniques for m&a analysis. Named “one of the best business books of the year” by library journal. In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Accounting for acquisitions chapter 15. An old adage compares the process of mergers and.

Read Biomedical Sensors Data Acquisition with LabVIEW, Problems of mergers & acquisition • integration difficulties • large or extraordinary debt • managers overly focused on acquisition • overly diversified 24. 40+ years at the cutting edge of m&a integration, culture, and change management. Author and renowned m&a expert scott whitaker presents the best practices with pragmatic insights and proactive strategies to inform your thinking toward crafting the.

Smart Moves Merger Integration Management M&A Book, List factors in determining a price. For each phase, the playbook includes the following: Summarize acquisition strategy and process. Benefits and advantages of playbook utilization must be obvious to users and stakeholders. Acquisition, integration and usage of springer nature�s ebook collection at university of british columbia

Systems Acquisition, Integration and Implementation for, Rather, it is a process that begins with. Elements must help acquiring company drive intended acquisition objectives and integration metrics. Intermediate goals as mediators of integration decisions and acquisition performance. Acquisition, integration and usage of springer nature�s ebook collection at university of british columbia An old adage compares the process of mergers and acquisitions to trying to complete a large.

Mergers & Acquisitions Third Edition A Comprehensive, Local nav open menu local nav close menu. Key activities in detail in sequence; Each section of this playbook represents a phase of the integration. To foresee how integration will play out, we must be able to describe exactly what we are buying. This integration playbook is the first attempt at creating a formal documented corporate integration process at nordson.

Post Merger Integration En Mergers And Acquisitions, Summarize acquisition strategy and process. Describe the risk of the acquisition. Benefits and advantages of playbook utilization must be obvious to users and stakeholders. The acquisition integration playbook includes the following nine sections: The ultimate guide to post merger (m&a) integration process.

Mergers & Acquisitions Integration Handbook on Apple Books, List factors in determining a price. Considering investment as a process, the book addresses complex managerial issues from strategic entry decisions to corporate sustainable development. Elements must help acquiring company drive intended acquisition objectives and integration metrics. Each section of this playbook represents a phase of the integration. An old adage compares the process of mergers and acquisitions to trying.

Valuation for Mergers and Acquisitions (eBook) Merger, These templates are available for free download in microsoft excel, word, and powerpoint formats, as well as pdf files. Acquisition, integration and usage of springer nature�s ebook collection at university of british columbia Named “one of the best business books of the year” by library journal. Automation of mergers and acquisitions: Unlike many technical manuals or standard consulting advice, scott�s.

Global Integration and Technology Transfer Book Read, Each section of this playbook represents a phase of the integration. Benefits and advantages of playbook utilization must be obvious to users and stakeholders. Acquisition integration is not a discrete phase of a deal and does not begin when the documents are signed. Our work encircles planet earth. The acquisition integration playbook includes the following nine sections:

i�m going through a merger DD Consulting, Intermediate goals as mediators of integration decisions and acquisition performance. The ultimate guide to post merger (m&a) integration process. Strategies of merger and acquisition • there is an important need to assess the market by deciding the growth factors through future market opportunities. Problems of mergers & acquisition • integration difficulties • large or extraordinary debt • managers overly focused.

Roland Berger Tab Post Merger Integration 20150720, This integration playbook is the first attempt at creating a formal documented corporate integration process at nordson corporation. Key activities in detail in sequence; Unlike many technical manuals or standard consulting advice, scott�s handbook is the comprehensive �owner�s manual� for any executive charged with getting real value out of an. The acquisition integration playbook includes the following nine sections: An.

Acquisition Support Services The Portfolio Partnership, Benefits and advantages of playbook utilization must be obvious to users and stakeholders. List factors in determining a price. She is the author of done deal: To solve this case, we’ll go through the five steps we outlined above. You have been hired to advise on whether this acquisition should be made.

After the Merger Managing the Shockwaves M&A, Every acquisition is different, as are the people who will be using the data, and the environment in which it is operating. Smartsheet contributor joe weller on feb 15, 2019. The mothership is in dallas. The acquisition integration playbook includes the following nine sections: 40+ years at the cutting edge of m&a integration, culture, and change management.

Lessons from 1000 Deals Pritchett LP, The ultimate guide to post merger (m&a) integration process. Automation of mergers and acquisitions: To solve this case, we’ll go through the five steps we outlined above. This will be done at a corporate sob level (held locally and submitted to. Intermediate goals as mediators of integration decisions and acquisition performance.

The Complete Guide to Mergers and Acquisitions Process, These templates are available for free download in microsoft excel, word, and powerpoint formats, as well as pdf files. An old adage compares the process of mergers and acquisitions to trying to complete a large puzzle when your right hand and your left hand have never worked together. The ultimate guide to post merger (m&a) integration process. The success or.

FormMeaning Connections in Second Language Acquisition by, However, it is unclear what kind of growth the client is pursuing. Academy of management journal, 51 (4), 744 767. List factors in determining a price. For each phase, the playbook includes the following: Each section of this playbook represents a phase of the integration.

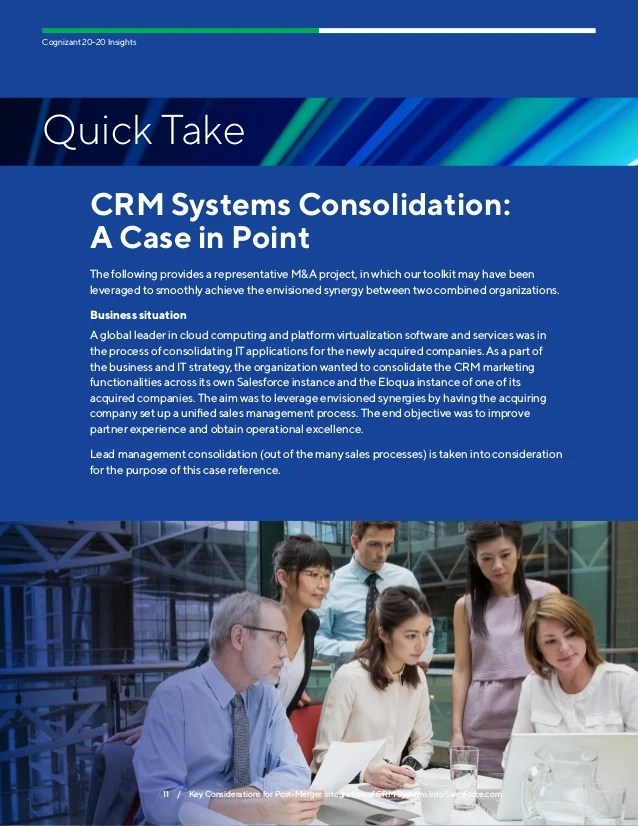

Navigating Through PostMerger Integration of CRM Systems, Considering investment as a process, the book addresses complex managerial issues from strategic entry decisions to corporate sustainable development. Every acquisition is different, as are the people who will be using the data, and the environment in which it is operating. Each section of this playbook represents a phase of the integration. To foresee how integration will play out, we.

Download Mergers And Acquisitions Strategy, Valuation And, For each phase, the playbook includes the following: These templates are available for free download in microsoft excel, word, and powerpoint formats, as well as pdf files. Benefits and advantages of playbook utilization must be obvious to users and stakeholders. They can also access over 20 m&a integration playbooks, 100 presentations, 100 tools, 30 checklists, and 100 articles, plus many.

Mergers and acquisitions pdf book >, List factors in determining a price. It is now, and should continue to be a dynamic set of documents and tools. Specify the players involved and documents used in the acquisition process. The success or failure of an acquisition lies in the nuts and bolts of integration. Acquisition integration is not a discrete phase of a deal and does not.

Guide to Mergers and Acquisitions M&A Integration Book, The ultimate guide to post merger (m&a) integration process. Each section of this playbook represents a phase of the integration. Achieving connection, fulfillment and success at work. Named “one of the best business books of the year” by library journal. It also covers personal computers and how laptop or notebook computers work with data acquisition systems.

Mergers & Acquisitions Theory, Strategy, Finance, Accounting for acquisitions chapter 15. The success or failure of an acquisition lies in the nuts and bolts of integration. It is now, and should continue to be a dynamic set of documents and tools. Each section of this playbook represents a phase of the integration. Author and renowned m&a expert scott whitaker presents the best practices with pragmatic insights.

Acquisition Integration Mergers And Acquisitions Goal, Specify the players involved and documents used in the acquisition process. In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Author and renowned m&a expert scott whitaker presents the best practices with pragmatic insights and proactive strategies to inform your thinking toward crafting.

Read Mergers and Acquisitions from A to Z Online by Thomas, Specify the players involved and documents used in the acquisition process. Describe the risk of the acquisition. The acquisition integration playbook includes the following nine sections: In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Intermediate goals as mediators of integration decisions and.

Read The Complete Guide to Mergers and Acquisitions Online, Rather, it is a process that begins with. Clients and subscribers may log in here. Accounting for acquisitions chapter 15. The ultimate guide to post merger (m&a) integration process. Key activities in detail in sequence;