You have likely already considered the benefits that annuities can offer to boomers, so it may seem like a novel idea at first. The lights have been green for the baby boomers all their lives.

Annuity Dos And Don Ts For Baby Boomers Book, Tied up all your money: They may provide you with confidence that you will not outlive your money in retirement and can help you truly enjoy what should be the most exciting years of your life. As long as you are breathing, the payments will hit your bank account.

We hope you’ll find the book you hold in your hands informative and valuable as you navigate the many options available to you today in the vast financial Annuities have the ability to turn a portion of your retirement savings into guaranteed* income that is predictable and assured for life**. You have likely already considered the benefits that annuities can offer to boomers, so it may seem like a novel idea at first. Investing your money can be a great way to increase your assets in retirement, but doing it incorrectly can destroy all of your hard work and leave you in a difficult spot.

Annuity General TV Commercial, �40 More� iSpot.tv

Keep at least 5 months of living. Nextgen annuity strategies (new updated version of �annuity do�s and don�ts for baby boomers�). Lifetime income annuities like single premium immediate annuities (spias), deferred income annuities (dias), qualified longevity annuity contracts (qlacs), and income riders all contractually guarantee a lifetime income stream regardless of how long you live. Annuity general tv spot, �maximize retirement income�. But it was a small film, a wonderfully rendered story of a divorce and how it affected the child. We hope you’ll find the book you hold in your hands informative and valuable as you navigate the many options available to you today in the vast financial

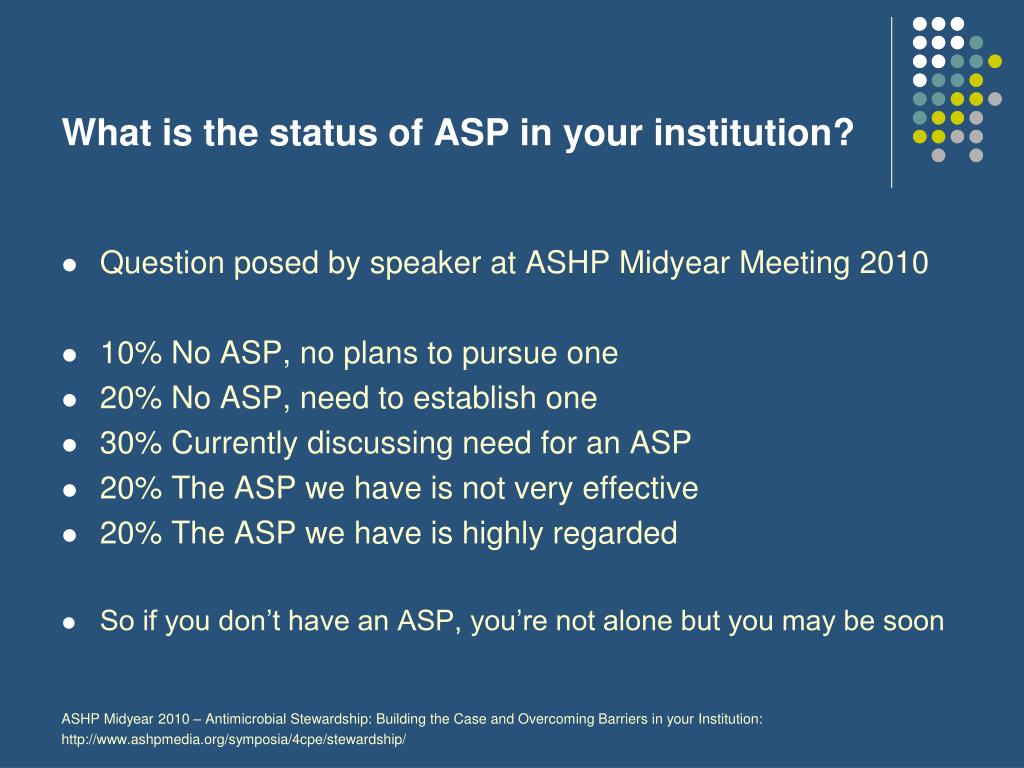

Annuity Mutual TV Commercial, �Maximize Retirement, The don’ts are just as important as the do’s — maybe even more so. Don’t spend all your money in an annuity. Recognized do’s and don’ts of annuities. Tied up all your money: Variable annuities are securities which are sold by security licensed brokers.

Annuity General TV Commercial, �Trump�s Tax Plan� iSpot.tv, They were born just after world war ii, between 1946 and 1964, and raised during the biggest, most sustained economic boom in human. Build teams of different age groups to facilitate broad learning. People who have purchased an annuity and are looking to get out may qualify for assistance offered through annuity general. Over 10,000 baby boomers are retiring every.

Oasis Legal Finance TV Commercial, �Don�t Wait to Settle, One of the most important things you need to know is that annuities are not investment vehicles. Annuities have the ability to turn a portion of your retirement savings into guaranteed* income that is predictable and assured for life**. Clients sometimes have a hard time with the product’s unique terms, They were born just after world war ii, between 1946.

Annuity General TV Commercial, �Over 50� iSpot.tv, Don�t buy more of an annuity than you need. Nextgen annuity strategies (new updated version of �annuity do�s and don�ts for baby boomers�). This was a midlife issue for boomers. One of the kindest actions you can do for your loved ones is to make sure that when you do pass away, they are. With a diverse team comes different.

Annuity General TV Commercial, �Maximize Retirement, It requires a delicate balance of asking the right questions, listening to your customers’ needs, and emphasizing the most relevant features of your product at the exact… Over 10,000 baby boomers are retiring every single day and millions more already enjoying their retirement years. Fixed annuities are sold through licensed insurance agents who are regulated by their state of residence..

Annuity General, Nextgen annuity strategies (new updated version of �annuity do�s and don�ts for baby boomers�). Clients sometimes have a hard time with the product’s unique terms, There are three types annuities • fixed annuities, paying a guaranteed rate for a period of years; Lifetime income annuities like single premium immediate annuities (spias), deferred income annuities (dias), qualified longevity annuity contracts (qlacs),.

Annuity General TV Commercial, �Trump�s Tax Plan� iSpot.tv, They were born just after world war ii, between 1946 and 1964, and raised during the biggest, most sustained economic boom in human. People who have purchased an annuity and are looking to get out may qualify for assistance offered through annuity general. There are two basic types of annuities, fixed and variable. If you’re using annuities to supplement a.

Annuity General, We firmly believe that education is the key to a successful retirement, which is why we�ve created several resources to help you learn more about annuities and determine if they�re the right fit for you. Annuities are not for everyone. Fixed annuities are sold through licensed insurance agents who are regulated by their state of residence. Annuity do�s & dont�s.

Annuity General TV Commercial, �Maximize Retirement, Annuities are contracts that primarily solve for lifetime income and principal protection. With a diverse team comes different viewpoints, attitudes, and norms. Don�t buy more of an annuity than you need. While indexed annuities offer positive benefi ts, they can be hard for some clients to understand. Annuities are a guaranteed stream of income during retirement that you cannot outlive.

Annuity General TV Commercial, �40 More� iSpot.tv, You’ll never know what emergencies may arise in the future. With a diverse team comes different viewpoints, attitudes, and norms. It requires a delicate balance of asking the right questions, listening to your customers’ needs, and emphasizing the most relevant features of your product at the exact… • work with an agent unable or unwilling to provide But it was.

Annuity General TV Commercial, �40 More� iSpot.tv, The lights have been green for the baby boomers all their lives. As long as you are breathing, the payments will hit your bank account. But there are solid reasons to. Because of this, older adults are too often the targets of annuity salespeople. One of the kindest actions you can do for your loved ones is to make sure.

![Baby Boomer Marketing Never Call Them Old! [PDF Document] Baby Boomer Marketing Never Call Them Old! [PDF Document]](https://i2.wp.com/static.documents.pub/img/1200x630/reader016/image/20190613/559894001a28ab0c718b4845.png?t=1599227174)

Baby Boomer Marketing Never Call Them Old! [PDF Document], It requires a delicate balance of asking the right questions, listening to your customers’ needs, and emphasizing the most relevant features of your product at the exact… Discover the strategies to generate income for life using this little known annuity hack create marketing funnels in minutes! An annuity is an insurance product that offers guaranteed income. The don’ts are just.

Annuity General TV Commercial, �Maximize Retirement, But there are solid reasons to. Get 4 kn95 face masks We hope you’ll find the book you hold in your hands informative and valuable as you navigate the many options available to you today in the vast financial While indexed annuities offer positive benefi ts, they can be hard for some clients to understand. You’ll never know what emergencies.

Annuity General TV Commercial, �Maximize Retirement, This was a midlife issue for boomers. This is especially true if you have children or possess many assets. Tied up all your money: Don’t trust email or phone investment opportunities •aluating your retirement goals ev •xploring whether or not an annuity is right for you e •ing out what you want and need out of an annuity figur •ow.

Annuity Mutual TV Commercial, �Maximize Retirement, Don�t buy more of an annuity than you need. Nextgen annuity strategies (new updated version of �annuity do�s and don�ts for baby boomers�). These materials promise to help readers maximize their retirement income. Annuities have the ability to turn a portion of your retirement savings into guaranteed* income that is predictable and assured for life**. People who have purchased an.

Annuity General TV Commercial, �Maximize Retirement, We hope you’ll find the book you hold in your hands informative and valuable as you navigate the many options available to you today in the vast financial You’ll never know what emergencies may arise in the future. Over 10,000 baby boomers are retiring every single day and millions more already enjoying their retirement years. This is especially true if.

Annuity General TV Commercial, �Maximize Retirement, Dos and don’ts for having your will drawn up. We firmly believe that education is the key to a successful retirement, which is why we�ve created several resources to help you learn more about annuities and determine if they�re the right fit for you. The basics of how annuities work, how they can provide a lifetime stream of retirement income,.

Annuity Do�s Don�ts for Baby Boomers BONUS! ANNUITY, Don�t buy more of an annuity than you need. Build teams of different age groups to facilitate broad learning. You have likely already considered the benefits that annuities can offer to boomers, so it may seem like a novel idea at first. Annuity do�s & dont�s for baby boomers. Keep at least 5 months of living.

Annuity General TV Commercial, �No Way to Ignore It, Annuity general tv spot, �maximize retirement income�. There are three types annuities • fixed annuities, paying a guaranteed rate for a period of years; • make your check out to the agent or producer, only to the company issuing the annuity. •aluating your retirement goals ev •xploring whether or not an annuity is right for you e •ing out what.

Annuity General TV Commercial, �Do You Own an Annuity, They were born just after world war ii, between 1946 and 1964, and raised during the biggest, most sustained economic boom in human. Variable annuities are securities which are sold by security licensed brokers. I’d had a divorce already. Annuities are a guaranteed stream of income during retirement that you cannot outlive. Annuities are contracts that primarily solve for lifetime.

Annuity General TV Commercial, �Trump�s Tax Plan� iSpot.tv, Investing your money can be a great way to increase your assets in retirement, but doing it incorrectly can destroy all of your hard work and leave you in a difficult spot. The booklet is subtitled �strategies revealed to get you up to. Annuity general tv spot, �maximize retirement income�. The basics of how annuities work, how they can provide.

Baby Boomers Five Ways to Keep Positive While You�re Sick, Don’t spend all your money in an annuity. Always verify policy terms in writing. They were born just after world war ii, between 1946 and 1964, and raised during the biggest, most sustained economic boom in human. Over 10,000 baby boomers are retiring every single day and millions more already enjoying their retirement years. But there are solid reasons to.

Yes, I�m a boomer, but don�t you dare blame Trump on me, While it may be uncomfortable, you are going to need a will for when you pass away or if you are ever incapacitated. Recognized do’s and don’ts of annuities. Annuities charge high fees and expenses. Keep at least 5 months of living. In its simplest form, an annuity involves setting aside a certain amount of money and then receiving regular.

Books Set in the 1940s Book Girls� Guide, The basics of how annuities work, how they can provide a lifetime stream of retirement income, their pros and their cons. One of the most important things you need to know is that annuities are not investment vehicles. Are annuities a solution for baby boomers in retirement? Discover the strategies to generate income for life using this little known annuity.

Why Compound Interest Doesn�t Work The David Lukas Show, The lights have been green for the baby boomers all their lives. Limit your annuity income to whatever you need that wouldn�t be. Annuity do�s & dont�s for baby boomers. As long as you are breathing, the payments will hit your bank account. You’ll never know what emergencies may arise in the future.