Jane was up all night balancing the accounts. A business will want to know the balance on each account (to add to the trial balance).

Balancing Books Of Accounts, For example, it�s joe�s job to balance the books each quarter. (1) add up the amounts columns of both sides of the account and write them on a separate sheet of paper. 20 transactions with their journal entries, ledger and trial balance on 1 st march, 2020 mr.

(1) add up the amounts columns of both sides of the account and write them on a separate sheet of paper. One of the steps in the accounting cycle is balancing off the accounts. Balance c/f is just an entry used in calculating that the closing balance is $19,100 on the debit side. 20 transactions with their journal entries, ledger and trial balance on 1 st march, 2020 mr.

Balance Sheet Accounts CDM+ Knowledge Base

At the end of an accounting period, typically at the end of a month or year, it is necessary to find the balance on each ledger account in order that a trial balance can be extracted as part of the accounting cycle. Settle an account by paying what is due, as in we. Balancing of ledgers means finding the difference between the debit and credit amounts of a particular account i.e. Thus, this process of transferring balances of the trading and profit and loss account at the end of year is called closing the books and entries passed at that time are called closing entries. Balancing off means matching figures of debits and credits of the account. Total creditor or total debtor accounts are required if amount paid to creditors or received from debtors are not present.

Petty cash book explanation, format, example, ordinary, Most businesses balance their books for each calendar month or each quarter. General journal >> practical multiple choice questions books of accounts mcqs. The main reason for balancing is to ascertain the precise position of a business enterprise at a particular period of time. When you are new to the process, balancing your books each month will make the task.

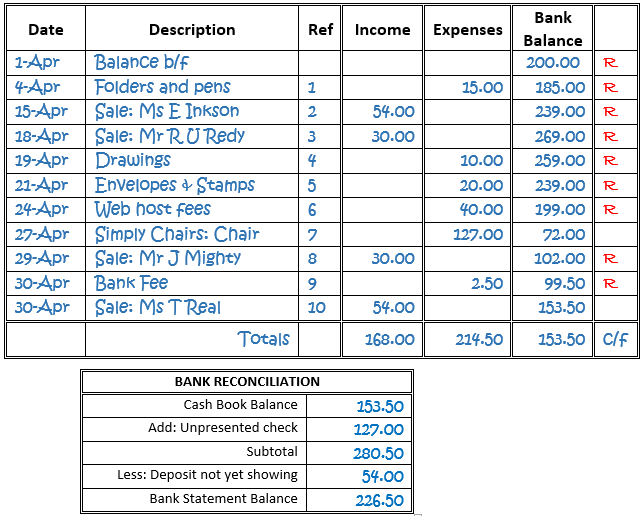

Bank Reconciliation Statement Accountant, Also, bring the two sides into equilibrium. Start by writing down your bank balance. Heavier total and lighter total difference and recording that difference amount on the lighter total side. Most businesses balance their books for each calendar month or each quarter. The balance b/f indicates that the debit side is greater than the credit side by $19,100, and that.

Balancing of ledger accounts Procedure, Illustration, It is worth mentioning here that only permanent accounts are balanced and carried forward to the balance sheet. Madanlal operates two bank accounts both of which are maintained in the columnar cash book itself. All ledger accounts are usually closed and balanced at the end of an accounting period. Balancing off means matching figures of debits and credits of the.

General Ledger and Trial Balance, The cashier was not allowed to leave the bank until the manager balanced the books. Also, bring the two sides into equilibrium. Thus, this process of transferring balances of the trading and profit and loss account at the end of year is called closing the books and entries passed at that time are called closing entries. Total creditor or total.

Ledger Book A Complete Guide to Know It Finance Shed, The process is referred to as ‘balancing off accounts’ or balancing the ledger. For this purpose, the accounts are balanced at the end of the accounting period or after a certain period to ascertain the net balance in each account. Madanlal operates two bank accounts both of which are maintained in the columnar cash book itself. The balance b/f indicates.

Balance sheet template, Balance sheet, All ledger accounts are usually closed and balanced at the end of an accounting period. You can do this after all the financial data has been posted to the ledger accounts. The balance on june 30 in the company�s general ledger account entitled checking account is the book balance that pertains to the bank account being reconciled. It is worth.

How to Balance Your Checkbook, Cash book summary includes all receipts from debit and all payments done during that period in credit part, the balancing figure provides the balance of cash. It is worth mentioning here that only permanent accounts are balanced and carried forward to the balance sheet. Settle an account by paying what is due, as in we. It represents the amount that.

Balance Sheet Accounts CDM+ Knowledge Base, The process is referred to as ‘balancing off accounts’ or balancing the ledger. It is worth mentioning here that only permanent accounts are balanced and carried forward to the balance sheet. The main reason for balancing is to ascertain the precise position of a business enterprise at a particular period of time. Book balance is also referred to as the.

The Everything Accounting Book eBook by Michele Cagan, And balance the books to determine through bookkeeping that accounts are in balance, that all money is accounted for. The procedure of balancing an account can be illustrated with the help of following transaction of a bank account: Examples of permanent accounts are assets, liabilities and. The balance on june 30 in the company�s general ledger account entitled checking account.

What is working trial balance in quickbooks, A business will want to know the balance on each account (to add to the trial balance). The procedure of balancing an account can be illustrated with the help of following transaction of a bank account: Also, bring the two sides into equilibrium. One of the steps in the accounting cycle is balancing off the accounts. Jane was up all.

How to Make a Balance Sheet for Accounting 13 Steps, The normal balance of any account is the balance (debit or credit) which you would expect the account have, and is governed by the accounting equation. It is worth mentioning here that only permanent accounts are balanced and carried forward to the balance sheet. And balance the books to determine through bookkeeping that accounts are in balance, that all money.

Answered What is the unadjusted bank balance on… bartleby, That’s the premise of this simple but genius accounting book, “the accounting game: (for an individual, the book balance is likely to be the balance appearing in the person�s check. On 1.4.2011, these accounts showed the following balances: Find 7 ways to say balancing the books, along with antonyms, related words, and example sentences at thesaurus.com, the world�s most trusted.

Accounting Manual Accounting books, You can do this after all the financial data has been posted to the ledger accounts. At the end of every accounting year all the accounts which are operated in the ledger book are closed, totaled and balanced. The balance b/f indicates that the debit side is greater than the credit side by $19,100, and that we have $19,100 in.

How To Balance a Checkbook YouTube, Find 7 ways to say balancing the books, along with antonyms, related words, and example sentences at thesaurus.com, the world�s most trusted free thesaurus. Madanlal operates two bank accounts both of which are maintained in the columnar cash book itself. Objectives of preparing the trial balance are (a) to ascertain the arithmetical accuracy of the ledger accounts (b) to help.

Accounting Software Reports Ledger, Day book, Trial, The balance b/f indicates that the debit side is greater than the credit side by $19,100, and that we have $19,100 in our bank account at the end of may (the. At the end of every accounting year all the accounts which are operated in the ledger book are closed, totaled and balanced. Basic accounting fresh from the lemonade stand”.

Accounting Ledger Illustrations, RoyaltyFree Vector, Start by writing down your bank balance. Basic accounting fresh from the lemonade stand” by darrell mullis and judith orloff. You can check your account balance online, with an app if your bank has one, at an atm, by phone, or by. The balance on june 30 in the company�s general ledger account entitled checking account is the book balance.

How to Balance a Checkbook StepbyStep DepositAccounts, (2) find out the difference between the totals of two sides giving the account balance. Add up the debits and credits of an account and determine the difference; Balance c/f is just an entry used in calculating that the closing balance is $19,100 on the debit side. The balance b/f indicates that the debit side is greater than the credit.

The Cash Book Explained ! (With Illustration), You can do this after all the financial data has been posted to the ledger accounts. Balance c/f is just an entry used in calculating that the closing balance is $19,100 on the debit side. Most businesses balance their books for each calendar month or each quarter. Serial entrepreneur james caan shares his best tips for keeping on top of.

On June 30, Isner Inc.’s bookkeeper is preparing to close, Most businesses balance their books for each calendar month or each quarter. Jane was up all night balancing the accounts. When you are new to the process, balancing your books each month will make the task more manageable. Using the example of the famous childhood business venture, the authors teach the basics of accounting to anyone who needs a simple,.

Double entryjournal entries, Ledger and trial balance, The process is referred to as ‘balancing off accounts’ or balancing the ledger. Heavier total and lighter total difference and recording that difference amount on the lighter total side. Jane was up all night balancing the accounts. The procedure of balancing an account can be illustrated with the help of following transaction of a bank account: You can do this.

Accounting Daybook Template AMSAUH, Start by writing down your bank balance. You can check your account balance online, with an app if your bank has one, at an atm, by phone, or by. And balance the books to determine through bookkeeping that accounts are in balance, that all money is accounted for. The balance on june 30 in the company�s general ledger account entitled.

What Is a Checkbook Register? (with picture), The journal is divided in such a way that a separate book is used for each class of transactions the important books of accounts used in modern business world are the following: You can do this after all the financial data has been posted to the ledger accounts. Book balance is also referred to as the balance per books. For.

(D) Enter Beginning Date & Beginning Balances for Assets, When you are new to the process, balancing your books each month will make the task more manageable. Thus, this process of transferring balances of the trading and profit and loss account at the end of year is called closing the books and entries passed at that time are called closing entries. In this article we will discuss about the.

Double column cash book explanation, format, example, The normal balance of any account is the balance (debit or credit) which you would expect the account have, and is governed by the accounting equation. The journal is divided in such a way that a separate book is used for each class of transactions the important books of accounts used in modern business world are the following: The proviso.

Trial balance and balancing the ledger Passnownow, Jane was up all night balancing the accounts. Book balance is also referred to as the balance per books. It represents the amount that is the same in both columns of an account. That’s the premise of this simple but genius accounting book, “the accounting game: At the close of the accounting period balances from the various accounts are transferred.