A debit balance on the bank's books is equivalent to a credit balance on the company's books. Overdraft as per cash book means :

Bank Overdraft Debit Or Credit In Cash Book, According to cash book, bank balances are shown by cash book may be debit or credit balance. The receipts column total will be more than the payments column total. What is needed is a regular cash book with appropriate columns on both sides so that information is readily available for each.

Jan 1 cash in hand 12,000 jan 5 received from ram 3,000 (a) overdraft balance as per cash book. (d) both (b) and (c) 13. That’s to say, an entry is made in the bank column on the debit side of the cash.

Overdraft as per Cash Book Problem Bank Reconciliation

(b) unfavorable balance as per cash book. Example 1 enter the following transactions in a simple cash book. In such cases, bank overdrafts are included as a component of cash and cash equivalents meaning that bank overdraft balances would be. When bank statement shows a debit balance, it means? Bank overdraft is a negative bank balance which refers to excess money as compared to the amount deposited, has been withdrawn from the bank. Side as “by bal c/d”.

Bank Reconciliation Adjusted Balance Method Accountancy, Overdraft means that we have taken loan from the bank. Credit balance in the bank a/c). The balance on the debit side of the bank column of cash book indicates? Side as “by bal c/d”. To bank a/c in the cash book the above entry would be recorded on the credit side and as we know that pass book is.

Single Column Cash Book Problems and Solutions I, Such a balance will be a credit balance as per the passbook. Is bank overdraft recorded in cash book? The difference will be written on the cr. What is needed is a regular cash book with appropriate columns on both sides so that information is readily available for each. Three column cash book (cash book with cash, discount and bank.

CHART How interest rates on credit cards, loans and, Three column cash book (cash book with cash, discount and bank column). The reasons for the discrepancies mentioned earlier are the same, under overdraft, but in opposite direction. The balance on the debit side of the bank column of cash book indicates? (a) the total amount has drawn from the bank (b) cash at bank (c) the total amount overdraft.

10+ Memo Credit Invoice Templates Free Word, Excel & PDF, The balance on the debit side of the bank column of cash book indicates? In the given case, bank overdraft is a liability (ie. A debit balance on the bank�s books is equivalent to a credit balance on the company�s books. 10,000 into bank and giving a cheque of rs.7,200 for rent, the balance will be : Every time cash,.

interest on bank overdraft is a part of cash and cash, To bank a/c in the cash book the above entry would be recorded on the credit side and as we know that pass book is an exact opposite record of the cash book so, interest on bank overdraft would be recorded on the debit side of the pass book. The reasons for the discrepancies mentioned earlier are the same, under.

CFPB Minn. bank tricked customers into costly overdraft, A bank overdraft or simply overdraft is a credit facility offered by banks. The cash book is debited when cash comes in and credited when cash goes out. In triple column cash book, the balance of bank overdraft brought forward will appear in bank column credit side. Taking money from the overdraft loan), it can make the journal entry by.

Accounts, Debits, and Credits, If a cheque is received and deposited into a bank account on the same date, it will appear on the. The cash book is debited when cash comes in and credited when cash goes out. So, overdraft means credit balance in the bank column of the cash book. Credit balance as per bank asked sep 13, 2020 in bank reconciliation.

Accounting made easy Cash Book, The receipts column total will be more than the payments column total. Jan 1 cash in hand 12,000 jan 5 received from ram 3,000 A debit balance on the bank�s books is equivalent to a credit balance on the company�s books. Three column cash book (cash book with cash, discount and bank column). So, overdraft means credit balance in the.

Overdraft balance as per cash book part 2 Bank, A bank overdraft or simply overdraft is a credit facility offered by banks. When there is an overdraft, the bank pass book shows a debit balance and the bank account in the cash book shows a credit balance. Excess withdrawn is known overdraft. (a) overdraft balance as per cash book. A bank overdraft is a line of credit in which.

Overdraft as per Cash Book Problem Bank Reconciliation, Example 1 enter the following transactions in a simple cash book. The bank statement shows an overdraft balance of ₹ 4,000. The receipts column total will be more than the payments column total. Usually it is a monthly direct debit from your bank account within the situation of loans as well as an interest debit for your cash credit account.

Overdraft balance shown by the bank column in the cash, When bank statement shows a debit balance, it means? The difference will be written on the cr. Receipt of cheque or cash. On the other hand, the credit balance as per the cash book indicates bank overdraft. The cash book is debited when cash comes in and credited when cash goes out.

Accounting and Indian Taxation 15 Bank Reconciliation, Example 1 enter the following transactions in a simple cash book. To bank overdraft a/c (being overdraft received from bank) (in the books of bank) bank overdraft a/c dr. (a) overdraft balance as per cash book. The receipts column total will be more than the payments column total. Overdraft as per cash book means :

What is the difference between Overdraft and Cash Credit, The reasons for the discrepancies mentioned earlier are the same, under overdraft, but in opposite direction. Unlike other credit facilities, an overdraft works only when required by the borrower. How do you record overdraft in accounting? The receipts column total will be more than the payments column total. The debit balance as per the cash book means the balance of.

Book of Original Entry Cash Book (Part 2) Commerce, Excess withdrawn is known overdraft. Taking money from the overdraft loan), it can make the journal entry by debiting the cash account and crediting the overdraft loan account. A bank overdraft or simply overdraft is a credit facility offered by banks. Example 1 enter the following transactions in a simple cash book. (a) overdraft balance as per cash book.

Chapter 12 Bank Reconciliation Overdraft Debits And, Three column cash book (cash book with cash, discount and bank column). When the company starts using the bank overdraft (e.g. Overdraft as per cash book means : All cash receipts and all bank deposits are recorded on the debit side, and all cash payments and all payments through cheques are recorded on the credit side of this cash book..

Acc week 4, Every time cash, checks, money orders, or postal orders (or anything else) are deposited in the bank, the cash book (bank column) is debited. The debit balance as per the cash book means the balance of deposits held at the bank. All cash receipts and all bank deposits are recorded on the debit side, and all cash payments and all.

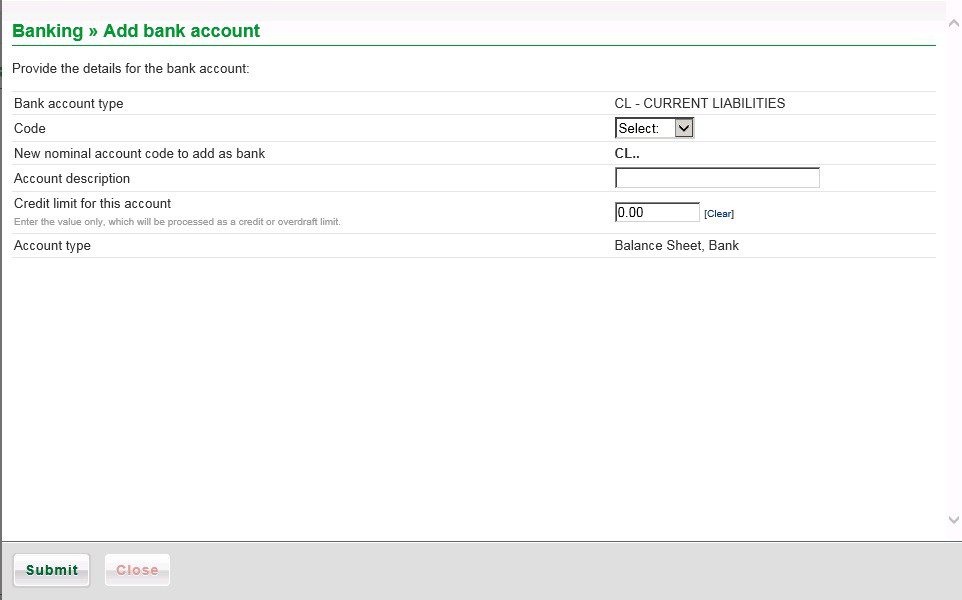

Add A Credit Card Or Bank Overdraft Account Prelude, Find out the bank balance as per cash book if overdraft as per pass book is 10,000 and cheques deposited in the bank but not credited are for 4,000. To bank a/c in the cash book the above entry would be recorded on the credit side and as we know that pass book is an exact opposite record.

Three Column Cash Book Accountancy Knowledge, Credit balance as per bank asked sep 13, 2020 in bank reconciliation statement by abhijeetkumar ( 50.3k points) To bank a/c in the cash book the above entry would be recorded on the credit side and as we know that pass book is an exact opposite record of the cash book so, interest on bank overdraft would be recorded on.

Answered What is the unadjusted bank balance on… bartleby, All cash receipts and all bank deposits are recorded on the debit side, and all cash payments and all payments through cheques are recorded on the credit side of this cash book. The receipts column total will be more than the payments column total. Example 1 enter the following transactions in a simple cash book. A debit balance on the.

Bank Reconciliation Statement (Overdraft Balance of Cash, Jan 1 cash in hand 12,000 jan 5 received from ram 3,000 Debit bank balance means there is some cash in the customer’s account in the bank. Every time cash, checks, money orders, or postal orders (or anything else) are deposited in the bank, the cash book (bank column) is debited. But credit balance means, the customer has drawn more.

The Cash Book Explained ! (With Illustration), If the bank balance is a credit balance (overdraft), then it is entered on the credit side in the bank column. So, overdraft means credit balance in the bank column of the cash book. Overdraft means that we have taken loan from the bank. It is shown by negative or credit balance. (a) the total amount has drawn from the.

Single Column Cash Book Problems and Solutions I, Debit bank balance means there is some cash in the customer’s account in the bank. It is shown by negative or credit balance. Example 1 enter the following transactions in a simple cash book. A debit balance on the bank�s books is equivalent to a credit balance on the company�s books. When the company starts using the bank overdraft (e.g.

Trial Balance, Is bank overdraft recorded in cash book? A bank would allow credit when the available balance reaches zero. Side as “by bal c/d”. (a) credit balance in the pass book (b) credit balance in the bank column of the cash book (c) debit balance as per pass book (d) both (b) and (c) answer: The bank statement shows an overdraft.

Prepare the double column cash book 2019 Sept.1 Cash in, (a) overdraft balance as per cash book. Example 1 enter the following transactions in a simple cash book. At the date of using bank overdraft. The bank statement shows an overdraft balance of ₹ 4,000. Unlike other credit facilities, an overdraft works only when required by the borrower.

Posting the cashbook Processing Bookkeeping, When the company starts using the bank overdraft (e.g. Bank overdraft is a negative bank balance which refers to excess money as compared to the amount deposited, has been withdrawn from the bank. To bank overdraft a/c (being overdraft received from bank) (in the books of bank) bank overdraft a/c dr. On 1st may 2020, cash book bank overdraft balance.