It is the fourth step of solution related to bank reconciliation statement problems and solution. Interest charged by the bank will be added because it will increase the overdraft as shown by the cash book.

Bank Overdraft Entry In Cash Book, Entries for overdraft/cash credit (od/cc limit) overdraft/cash credit is a kind of negative bank account. Debit bank balance means there is some cash in the customer’s account in the bank. However, when the balance as per cash book is negative while the balance as per bank book is positive, it is referred to as book overdraft.

(ii) interest on bank overdraft not entered in the cash book ₹ 2,000. With the help of cash book cash and bank balance can be checked at my point of time. If the bank balance is a credit balance (overdraft), then it is entered on the credit side in the bank column. 1,200 by cash and rent by check rs.

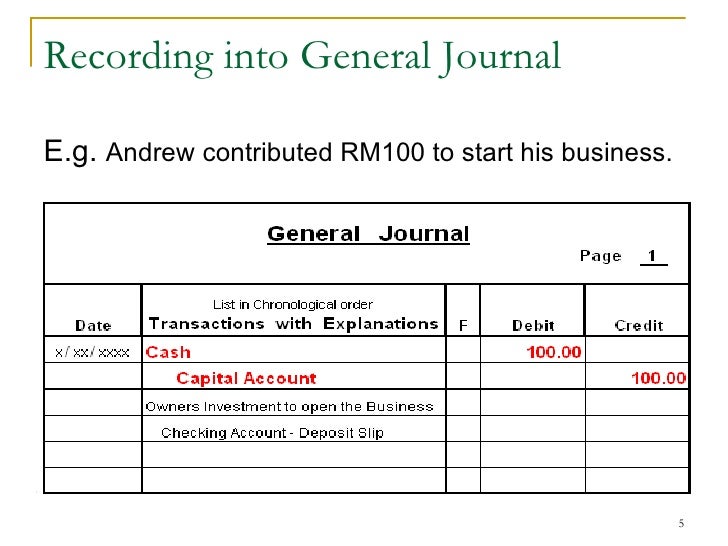

The Cash Book Explained ! (With Illustration)

Types of cash book cash book can be of four types: Interest charged by the bank will be added because it will increase the overdraft as shown by the cash book. According to cash book, bank balances are shown by cash book may be debit or credit balance. Entries for overdraft/cash credit (od/cc limit) overdraft/cash credit is a kind of negative bank account. The brs statement can be tallied from cashbook to passb. The company should move the $24,000 to accounts payable via a journal entry.

Bank Reconciliation Statement (Overdraft Balance of Cash, Sold $160 of goods to p dixon on credit. Withdrew $50 of cash from the bank for business use. The cash book is debited when cash comes in and credited when cash goes out. The opening balance of cash in hand and cash at the bank are recorded on the debit side in the cash and bank columns, respectively. Hence,.

Bank Reconciliation Statement Problems and Solutions I BRS, (c) cheques issued but not cashed before 31st december 2006 amounted to rs. Hence, the overdraft as per cash book is ₹ 23,639. What is bank overdraft and how to adjust in brs? Book overdraft occurs when the business issues checks. On the other hand, the credit balance as per the cash book indicates bank overdraft.

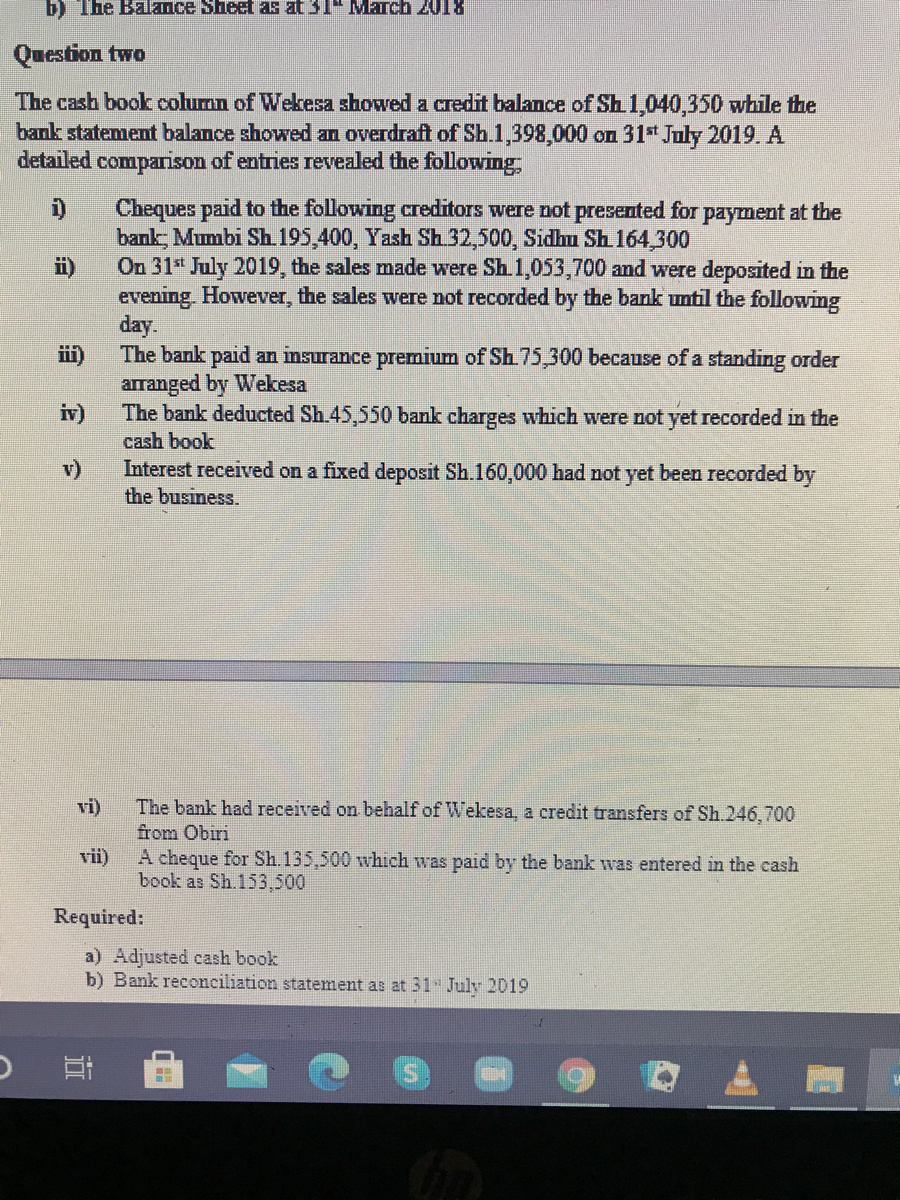

Answered Оиestion two The cash book column of… bartleby, Grewal, “ double entry book keeping”) 14.4. The entry for withdrawal of cash from bank account for business purpose is: At the date of using bank overdraft It goes to the balance sheet only when the company starts using it. Excess withdrawn is known overdraft.

Three Column Cash Book Accountancy Knowledge, The cash book is debited when cash comes in and credited when cash goes out. In such cases, bank overdrafts are included as a component of cash and cash equivalents meaning that bank overdraft balances would be. When the company starts using the bank overdraft (e.g. Withdrew $50 of cash from the bank for business use. Hence, it is given.

If A Company Has Overdrawn Its Bank Balance Then Quizlet, When overdraft as per pass book or debit balance as per cash book is given. In the cash book the above entry would be recorded on the credit side and as we know that pass book is an exact opposite record of the cash book so, interest on bank overdraft. But credit balance means, the customer has drawn more than.

Accounting and Indian Taxation 15 Bank Reconciliation, It goes to the balance sheet only when the company starts using it. Overdraft means that we have taken loan from the bank. Suppose bank sanction such limit for od/cc of 50 lacs,it means a person can have negative balance of maximum 50 lacs in bank account. The cash book is debited when cash comes in and credited when cash.

Three column cash book (Cash book with cash, discount and, The entry for withdrawal of cash from bank account for business purpose is: 1,200 by cash and rent by check rs. When the company starts using the bank overdraft (e.g. The brs statement can be tallied from cashbook to passb. When cash is withdrawn from bank account for business use:

Overdraft as per Cash Book Problem Bank Reconciliation, The $5,000 is not material. When the company starts using the bank overdraft (e.g. Taking money from the overdraft loan), it can make the journal entry by debiting the cash account and crediting the overdraft loan account. In the cash book the above entry would be recorded on the credit side and as we know that pass book is an.

Acc week 4, Bank [dr] cash [cr] the deposited amount is written in the bank column on debit side and cash column on credit side. Grewal, “ double entry book keeping”) 14.4. The cash book of a firm showed an overdraft of rs 30,000 on 31st march, 2012. Overdraft as per pass book and debit balance as per pass book is same. Helps.

32 BANK RECONCILIATION OVERDRAFT EXAMPLE, BANK EXAMPLE, During the week ended 6 may the following transactions took place. 5,000 and credit sales rs. Interest charged by the bank will be deducted, when the overdraft as per the cash book is the starting point for making the bank reconciliation statement. Excess withdrawn is known overdraft. The opening balance of cash in hand and cash at the bank are.

The Cash Book Explained ! (With Illustration), According to cash book, bank balances are shown by cash book may be debit or credit balance. Types of cash book cash book can be of four types: (i) on 22nd march, 2012, cheques totaling rs 6,000 were sent to banker’s tor collection. What is bank overdraft and how to adjust in brs? (b) interest on overdraft for six months.

Bank Reconciliation Principlesofaccounting Com, 200 is debited in the pass book. There is no journal entry required at the date of signing the agreement of the overdraft with the bank. Overdraft means that we have taken loan from the bank. Hence, it is given in case of those business where debtors are more than stock. What is bank overdraft and how to adjust in.

Accounting and Indian Taxation 15 Bank Reconciliation, Helps in fulfilling urgent cash requirements. (i) on 22nd march, 2012, cheques totaling rs 6,000 were sent to banker’s tor collection. In this video, the introduction to the debit balance and credit balance in the cashbook is presented. Following are the advantages of bank overdraft: Interest charged by the bank will be added because it will increase the overdraft as.

Acc week 4, When cash is withdrawn from bank account for business use: Overdraft means that we have taken loan from the bank. (b) interest on overdraft for six months ending 31st december 2006 rs. Cash overdraft in cash flow statement. According to cash book, bank balances are shown by cash book may be debit or credit balance.

Prepare the double column cash book 2019 Sept.1 Cash in, Here, amount = rs = $ = £ = € = ₹ = af = ৳ = nu = rf = රු =. Book overdrafts result in negative cash balances on the books of a company. Overdraft means that we have taken loan from the bank. Interest charged by the bank will be added because it will increase the overdraft.

Double Column/Two Column Cash Book Kofa Study, (b) interest on overdraft for six months ending 31st december 2006 rs. Hence, the overdraft as per cash book is ₹ 23,639. 1,200 by cash and rent by check rs. This is called bank overdraft and is liability for the business. If the debit side total of the bank column is more than its credit side is more than the.

The cash book in accounting, Overdraft as per pass book and debit balance as per pass book is same. Taking money from the overdraft loan), it can make the journal entry by debiting the cash account and crediting the overdraft loan account. (c) cheques issued but not cashed before 31st december 2006 amounted to rs. Book overdrafts result in negative cash balances on the books.

Single Column Cash Book Problems and Solutions I, Interest on bank overdraft a/c. At the date of using bank overdraft Cash book is a subsidiary book which records the receipts and payment of cash. An overdraft results in a short term liability (also see liability and shareholders’ equity accounts) as your business will have to settle the obligation with the bank. A cash book shows an overdraft of.

Bank Overdraft Arranged to Pay Retiring Partner Death of, Bank [dr] cash [cr] the deposited amount is written in the bank column on debit side and cash column on credit side. The cash book is debited when cash comes in and credited when cash goes out. It is the fourth step of solution related to bank reconciliation statement problems and solution. When overdraft as per pass book or debit.

PPT Cah Book III PowerPoint Presentation, free download, In the cash book the above entry would be recorded on the credit side and as we know that pass book is an exact opposite record of the cash book so, interest on bank overdraft. Interest needs to be paid only on the amount that is. There is no journal entry required at the date of signing the agreement of.

Overdraft balance shown by the bank column in the cash, The balance of the bank column of the cash book may appear on either side of the cash book. However, when the balance as per cash book is negative while the balance as per bank book is positive, it is referred to as book overdraft. When cash is withdrawn from bank account for business use: 200 is debited in the.

Simple Cash Book Format Design for Quick Money Tracking, On 1 may 20x9 marshall’s cash book showed a cash balance of $224 and an overdraft of $336. (i) on 22nd march, 2012, cheques totaling rs 6,000 were sent to banker’s tor collection. If the bank balance is a credit balance (overdraft), then it is entered on the credit side in the bank column. A comparison of the entries in.

Overdraft balance shown by the bank column in the cash, Types of cash book cash book can be of four types: A comparison of the entries in the cash book and pass book revealed that: On the other hand, the credit balance as per the cash book indicates bank overdraft. What is the journal entry for bank overdraft? Book overdrafts result in negative cash balances on the books of a.

32 BANK OVERDRAFT CASH FLOW STATEMENT, BANK FLOW OVERDRAFT, When the company starts using the bank overdraft (e.g. In this video, the introduction to the debit balance and credit balance in the cashbook is presented. If the debit side total of the bank column is more than its credit side is more than the debit side total then the difference represents an overdrawn balance. There is no journal entry.

interest on bank overdraft is a part of cash and cash, The company should move the $24,000 to accounts payable via a journal entry. Book overdrafts result in negative cash balances on the books of a company. In this case, the bank overdraft accounting treatment will be to include it as an accounts payable journal entry, with a coinciding increase to the total cash entry to balance. What is the journal.