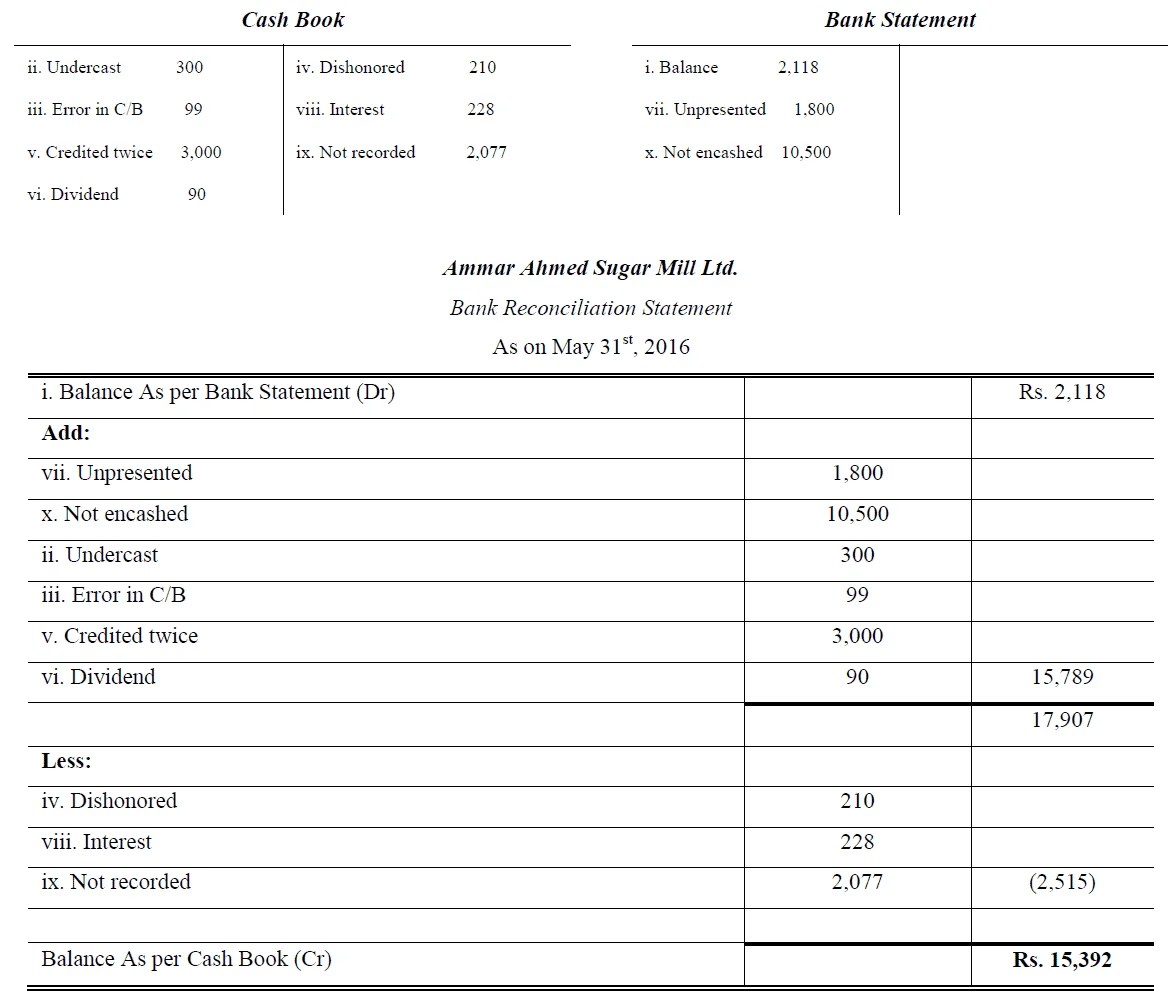

If one looks at the debit side of the cash book and the deposits column of the pass book, and checks item by item, one will find that the following cheques deposited with the bank. A bank reconciliation is the process of matching the balances in an entity's accounting records for a cash account to the corresponding information on a bank statement.

Bank Reconciliation Book Side, It is written by the depositor. We review their content and use your feedback to keep the quality high. Money deposited into a bank is recorded in the bank column of a cash book on the debit side while withdrawals are recorded on the credit side.

To keep a record of business transactions, a bank reconciliation statement (brs) comes into play.bank reconciliation statement is a statement which records differences between the bank statement and general ledger.the amount specified in the bank statement issued by the bank and the amount recorded in the organization’s accounting book maintained by chartered. @profalldredge for best viewing, switch t. A bank reconciliation is the process of matching the balances in an entity�s accounting records for a cash account to the corresponding information on a bank statement. It is written by the depositor.

Accounting and Indian Taxation 15 Bank Reconciliation

Cheques issued but not presented for payment to bank 40,000. The bank statement balance, i.e. Experts are tested by chegg as specialists in their subject area. It is a good practice to carry out this exercise at regular intervals, which helps in maintaining controls in the organization. Pass book of ms jane shows an overdraft of 50,000. You can do this by holding down the control ( ctrl) key and left.

Bank Reconciliation Statement Problems and Solutions I BRS, Add any increases (interest earned, bank credit memos) that are shown on the bank statement but were not yet recorded in the company�s cash account. The cash book balance, i.e. Need of preparing bank reconciliation statement a bank reconciliation statement is a statement reconciling the balance as When the reconciliation is completed, both balances should match. Match the deposits in.

Bank Reconciliation YouTube, Highlight all transactions that you wish to change. We have to check all the transactions recorded in the cash book with transactions recorded in the passbook by our bank. There are two parts to a bank reconciliation, the book (company) side and the bank side. Bank reconciliation statement is also known as bank passbook. After updating the bank balance of.

Accounting and Indian Taxation 15 Bank Reconciliation, What is a bank reconciliation? A bank reconciliation is the process of matching the balances in an entity�s accounting records for a cash account to the corresponding information on a bank statement. From the following particulars prepare a bank reconciliation statement on 31 st october xxxx. The goal of this process is to ascertain the differences between the two, and.

Bank Reconciliation Statement Problems and Solutions I BRS, There are two parts to a bank reconciliation, the book (company) side and the bank side. Payment side, bank column of cash book was undercast by 500. For a full and complete bank reconciliation, both sides must balance. The goal is to reconcile activity that occurred on both sides with each other. For each of the following items, indicate whether.

Bank Reconciliation Adjusted Balance Method Accountancy, This statement helps the account holders to check and keep track of their funds and update the transaction record that they have made. Bank reconciliation processes in which the balance of bank account in the books of company is matched with the balance of our company account in the books of bank. There are two parts to a bank reconciliation,.

Bank Reconciliation YouTube, The business’ record of their bank account, and; Match the deposits in the business records with those in the bank statement. Adjustments to bank (shown on the left side) are likely the items that are in the company�s general ledger cash account, but they are not yet recorded in the bank�s records. Compare the amount of each deposit recorded in.

Solved For Each Of The Items Indicate Whether Its Amount, The cash book shows a balance of rs 33,000, whereas the pass book shows a balance of rs 39,930. Money deposited into a bank is recorded in the bank column of a cash book on the debit side while withdrawals are recorded on the credit side. It is a good practice to carry out this exercise at regular intervals, which.

Preparation of bank reconciliation statement, To move book transactions to the bank side, follow these steps: Enter the unadjusted balance appearing in the company�s general ledger cash account. When the reconciliation is completed, both balances should match. Bank reconciliation statement is also known as bank passbook. Experts are tested by chegg as specialists in their subject area.

Solved Identifying Timing Differences Related To A Bank R, There are a number of items that can cause differences between your book and bank balances. 14.3 cash book in business most of the transactions relate to receipt of cash, payments of cash, sale of goods and purchase of goods. The good news is every entry will contain. A bank reconciliation is the process of matching the balances in an.

ACCOUNTING WAY (EDUCATIONAL) Bank reconciliation, Here is a list of the most common items you’ll encounter when doing a bank reconciliation: Its debit balance shows cash at bank and credit balance shows bank overdraft. The left side is labeled balance per bank. The good news is every entry will contain. A copy of it is also given to the customer for the knowledge in the.

Bank Reconciliation Reconciliation, General ledger, Bank reconciliation statement is a valuable tool to identify differences between the balance as per cash book and bank statement. Bank reconciliation statement is a statement prepared, periodically with a view to enlist the reasons for difference between the balances as per the bank column of the cashbook and pass book/bank statement on any given date. It is a good.

Accounting and Indian Taxation 15 Bank Reconciliation, Payment side, bank column of cash book was undercast by 500. Bank reconciliation processes in which the balance of bank account in the books of company is matched with the balance of our company account in the books of bank. A bank reconciliation is the process of matching the balances in an entity�s accounting records for a cash account to.

Bank Reconciliation Exercises and Answers Free Downloads, To keep a record of business transactions, a bank reconciliation statement (brs) comes into play.bank reconciliation statement is a statement which records differences between the bank statement and general ledger.the amount specified in the bank statement issued by the bank and the amount recorded in the organization’s accounting book maintained by chartered. Bank reconciliations only pull transactions back 13 months.

ACCOUNTING WAY (EDUCATIONAL) Bank reconciliation, When the reconciliation is completed, both balances should match. The cash book shows a balance of rs 33,000, whereas the pass book shows a balance of rs 39,930. In bank reconciliation, are nsf checks shown on the book side of the reconciliation? The goal of this process is to ascertain the differences between the two, and to book changes to.

10+ Bank Reconciliation Template Get Free Documents, Cheques issued but not presented for payment to bank 40,000. From cash book and pass book! Need of preparing bank reconciliation statement a bank reconciliation statement is a statement reconciling the balance as Money deposited is recorded on the debit side and money withdrawn on credit side 3. In simple words, it is the process of reconciling the balance of.

BANK RECONCILIATION PROCEDURES In a format similar to the, Add any increases (interest earned, bank credit memos) that are shown on the bank statement but were not yet recorded in the company�s cash account. To move book transactions to the bank side, follow these steps: Bank reconciliation also helps in detecting some frauds and manipulations. Match the deposits in the business records with those in the bank statement. It.

Bank Reconciliation Statement Problems and Solutions I BRS, Experts are tested by chegg as specialists in their subject area. From cash book and pass book! Notice the following items in the condensed bank reconciliation format: Interest on overdraft charged by the bank was 1,500. Thus, the purpose of a bank reconciliation is to check the accuracy of the bank balance in the entity’s ledger and to ensure that.

BB20S1 Bank Book Reconciliation Summary Report Elliott, For each of the following items, indicate whether its amount (i) affects the bank or book side of a bank reconciliation and (ii) represents an addition or a subtraction in a bank reconciliation: It is a good practice to carry out this exercise at regular intervals, which helps in maintaining controls in the organization. On the bank side of the.

Bank reconciliation report Manager Forum, For each of the following items, indicate whether its amount (i) affects the bank or book side of a bank reconciliation and (ii) represents an addition or a subtraction in a bank reconciliation: After recording the journal entries for the company’s book adjustments, a bank reconciliation statement should be produced to reflect all the changes to cash balances for each.

Bank Reconciliation Statement Problems and Solutions I BRS, It credits such account for deposits and debits such account for any withdrawals. After recording the journal entries for the company’s book adjustments, a bank reconciliation statement should be produced to reflect all the changes to cash balances for each month. The bank also maintains an account of a customer in its books of accounts. When the bank and book.

[Solved] Requirement 1. Prepare Hardy�s bank, 14.3 cash book in business most of the transactions relate to receipt of cash, payments of cash, sale of goods and purchase of goods. Money deposited into a bank is recorded in the bank column of a cash book on the debit side while withdrawals are recorded on the credit side. Experts are tested by chegg as specialists in their.

Bank Reconciliation Adjusted Balance Method Accountancy, The good news is every entry will contain. If one looks at the debit side of the cash book and the deposits column of the pass book, and checks item by item, one will find that the following cheques deposited with the bank. Bank reconciliation also helps in detecting some frauds and manipulations. Notice the following items in the condensed.

Blank Bank Statement Template Download Awesome form Bank, Money deposited into a bank is recorded in the bank column of a cash book on the debit side while withdrawals are recorded on the credit side. From cash book and pass book! (ii) preparation of bank reconciliation statement after adjusting cash book balance (corrected cash balance): The bank’s records of the bank account. The balance per books side of.

Bank Reconciliation Template With SidebySide Matching, Bank reconciliation statement is a valuable tool to identify differences between the balance as per cash book and bank statement. Add any increases (interest earned, bank credit memos) that are shown on the bank statement but were not yet recorded in the company�s cash account. The balance per books side of the bank reconciliation requires the following: It is a.

Bank Reconciliation Book Side YouTube, Interest on overdraft charged by the bank was 1,500. There are a number of items that can cause differences between your book and bank balances. What are we looking for? From cash book and pass book! A bank reconciliation is the process of matching the balances in an entity�s accounting records for a cash account to the corresponding information on.