Book value reveals how much the company is worth if it were liquidated and all assets were sold for cash. Investors use this metric to determine how a. Acb book value.

Acb Book Value, The market value in order to determine how much money was made or lost in their account over a given period. This is because the book value of a mutual fund will change. Book value is used from a tax perspective to determine if an investor is in a capital gain or loss position on a particular holding. Reported Book Value vs Adjusted Cost Base.

Clarifying The Book Value Mystery Highview Financial Group From highviewfin.com

Clarifying The Book Value Mystery Highview Financial Group From highviewfin.com

Book value and market value WHAT IS BOOK VALUE. This is because the book value of a mutual fund will change. Continuing with the example above lets see what would happen if you were to sell 100 shares for 15. The current price to book ratio for Aurora Cannabis as of November 30 2021 is.

Price to Book Ratio Definition.

Read another article:

Investors use this metric to determine how a. Aurora Cannabiss book value per share for the quarter that ended in Sep. Price to book value is a valuation ratio that is measured by stock price book value per share. However it is important to note that you will still pay taxes if you sell your TD e-Series funds and you should factor that in your decision on howwhen to sell these funds if they are in a taxable account. All of the ACB calculations should be done at the fund level and represented in the book value.

Source: highviewfin.com

Source: highviewfin.com

Book value can be adjusted because of change or improvement made to asset such as upgrades to real estate. In depth view into Aurora Cannabis Book Value per Share explanation calculation historical data and more. The market value in order to determine how much money was made or lost in their account over a given period. The net gain or loss on 3 mututal funds were between -4000 and 3000. Clarifying The Book Value Mystery Highview Financial Group.

Source: highviewfin.com

Source: highviewfin.com

Special rules can sometimes apply that will allow you to consider the cost of the capital property to be an amount other than its actual cost. ACB Book Value per Share as of today November 15 2021 is 842. Special rules can sometimes apply that will allow you to consider the cost of the capital property to be an amount other than its actual cost. 10 2021 View 4000 financial data types Browse. Clarifying The Book Value Mystery Highview Financial Group.

Source: goodreads.com

Source: goodreads.com

These rules apply to the following types of property. The adjusted cost base ACB is usually the cost of a property plus any expenses to acquire it such as commissions and legal fees. Price to book value is a valuation ratio that is measured by stock price book value per share. ACB Book Value per Share as of today November 15 2021 is 842. The Acb With Honora Lee By Kate De Goldi.

Source: researchgate.net

Source: researchgate.net

Book Value per Share-157. 10 2021 View 4000 financial data types Browse. However for most mutual funds the current book value listed on an account statement will not be the same as the original investment. For a detailed definition formula and example for PriceBook Ratio check out our new background page here. Impairment Test Comparison Between Book Value And Recoverable Value Download Scientific Diagram.

Price to Book Ratio Definition. All of the ACB calculations should be done at the fund level and represented in the book value. Investors use this metric to determine how a. Historical price to book ratio values for Aurora Cannabis ACB over the last 10 years. 2.

Source: slideshare.net

Source: slideshare.net

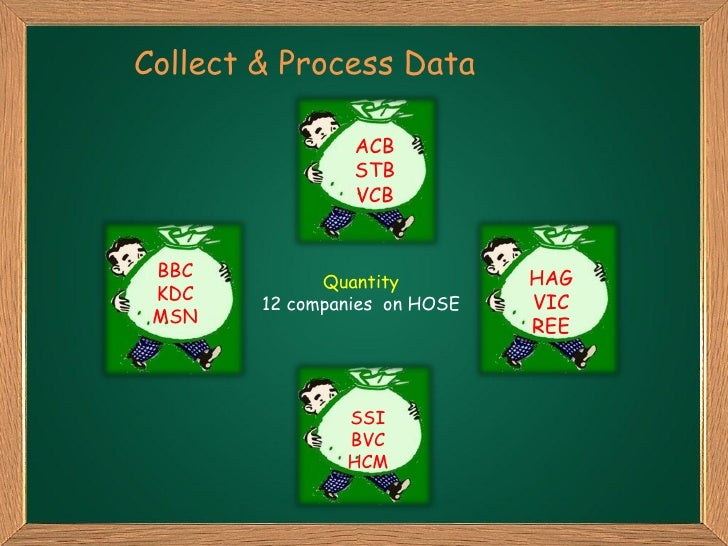

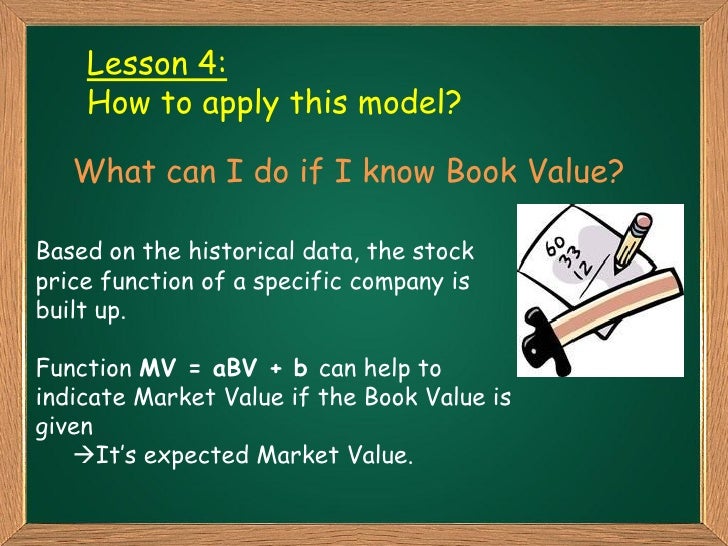

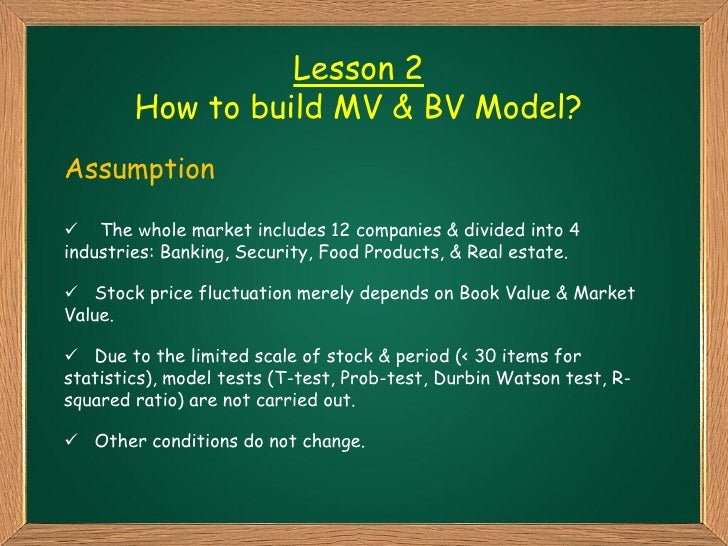

Adjusted cost base ACB is an income tax term that refers to an adjustment in an assets book value resulting from the cost of improvements payouts and similar improvements or. ACB Calculation Purchase Distributions are set up to be reinvested. Book Value per Share-157. It is used in calculating the capital gain or loss resulting from the sale of securities or mutual funds in a taxable portfolio. The Relationship Bt Book Value Market Value.

Source: slideshare.net

Source: slideshare.net

However for most mutual funds the current book value listed on an account statement will not be the same as the original investment. Adjusted Cost Base ACB is the total cost of all acquisitions in a given security divided by the total number of sharesunits sometimes referred to as Average Cost. Adjusted cost base ACB is an income tax term that refers to an adjustment in an assets book value resulting from the cost of improvements payouts and similar improvements or. The current price to book ratio for Aurora Cannabis as of November 30 2021 is. The Relationship Bt Book Value Market Value.

Reported Book Value vs Adjusted Cost Base. Book value reveals how much the company is worth if it were liquidated and all assets were sold for cash. By dividing book value by the total number of shares outstanding you can find book value. Adjusted Cost Base ACB is the total cost of all acquisitions in a given security divided by the total number of sharesunits sometimes referred to as Average Cost. The Abcs Of Tracking Your Acb The Globe And Mail.

Source: inspiredinvestor.rbcdirectinvesting.com

Source: inspiredinvestor.rbcdirectinvesting.com

However if you want to be 100 certain that your ACB is correct then you could track it. Book Value also known as Adjusted Cost Base or ACB is a concept that is often confusing to investors. Historical price to book ratio values for Aurora Cannabis ACB over the last 10 years. Does selling shares impact the Adjusted Cost Base ACB. What Is Book Value And Why Does It Matter.

Source: fool.com

Source: fool.com

10 2021 View 4000 financial data types Browse. Aurora Cannabiss book value per share for the quarter that ended in Sep. Get the latest Aurora Cannabis stock price and detailed information including ACB news historical charts and realtime prices. Price to Book Ratio Definition. This 1 Chart Explains Why Aurora Cannabis Has Been Such A Disaster The Motley Fool.

Source: tradingview.com

Source: tradingview.com

ACB Calculation Purchase Distributions are set up to be reinvested. What Is Adjusted Cost Base ACB. Book value is used from a tax perspective to determine if an investor is in a capital gain or loss position on a particular holding. Bough 10 shares at 9. Acb Stock Price And Chart Tsx Acb Tradingview.

Source: slideshare.net

Source: slideshare.net

ACB Book Value per Share as of today November 15 2021 is 842. For example if a company purchases an office building then invests more money towards expanding and updating the building combined costs are factored together to find an adjusted cost base. The adjusted cost base ACB is usually the cost of a property plus any expenses to acquire it such as commissions and legal fees. In depth view into Aurora Cannabis Book Value per Share explanation calculation historical data and more. The Relationship Bt Book Value Market Value.

Source: slideshare.net

Source: slideshare.net

Reported Book Value vs Adjusted Cost Base. Historical price to book ratio values for Aurora Cannabis ACB over the last 10 years. Assume you have the following. It is used in calculating the capital gain or loss resulting from the sale of securities or mutual funds in a taxable portfolio. The Relationship Bt Book Value Market Value.

Source: tradingview.com

Source: tradingview.com

However if you want to be 100 certain that your ACB is correct then you could track it. ACB price to book PB For valuing companies that are loss-making or have lots of physical asset Company 091x Industry 265x ACB is good value based on its book value relative to its share price 091x compared to the US Drug Manufacturers - Specialty Generic industry average 265x Valuation ACB s financial health Profit margin Revenue. ACB Book Value per Share as of today November 15 2021 is 842. It is used in calculating the capital gain or loss resulting from the sale of securities or mutual funds in a taxable portfolio. Acb Stock Price And Chart Asx Acb Tradingview.

Source: tradingview.com

Source: tradingview.com

What would be the risk of using the online brokers Royal. Aurora Cannabiss book value per share for the quarter that ended in Sep. 12unit x 100 1200 100 units purchased at 12unit ABC. Aurora Cannabis Price to Book Value ACBTO Aurora Cannabis Price to Book Value. Acb Stock Price And Chart Neo Acb Tradingview.