In the beginning of lease Lease Receivables Account Debit Fixed Asset Account Credit In the end of first year and subsequent years. The finance lease accounting journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of finance or capital leases. Accounting treatment of finance lease in the books of lessor.

Accounting Treatment Of Finance Lease In The Books Of Lessor, B In the Books of Lessee. Are calculated for the term of lease. Whereas the royalty which is paid on the basis of sales is debited to the Profit Loss Ac. The accounting treatment for royalty which will be in the books of the lessee will be royalty paid on the basis of output is debited to Trading or Manufacturing Account as it is considered as normal business expenditure.

Accounting Entries For Operating Leases With Case Study Example Learn Accounting Online From cost-management-financial-accounting.blogspot.com

Accounting Entries For Operating Leases With Case Study Example Learn Accounting Online From cost-management-financial-accounting.blogspot.com

The finance lease is reported by the lessee as follows on different financial statements. For Receiving the amount of lease. The finance lease accounting journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of finance or capital leases. Accounting for finance lease -in the books of lessor.

Financial statements of lessor will appear as follows.

Read another article:

For example rent received is of 5000 Lease. Unlike in lessee accounting treatment the lessee for tax purposes does not recognize an asset but rather claims as rental expense the amount of rent paid or accrued including all expenses that under the terms of the agreement the lessee is. This separation between the assets ownership lessor and control of the asset lessee is referred to as the agency cost of leasing. Lease agreements where the lessor maintains ownership are operating leases. Accounting for finance lease -in the books of lessor.

Source: cpajournal.com

Source: cpajournal.com

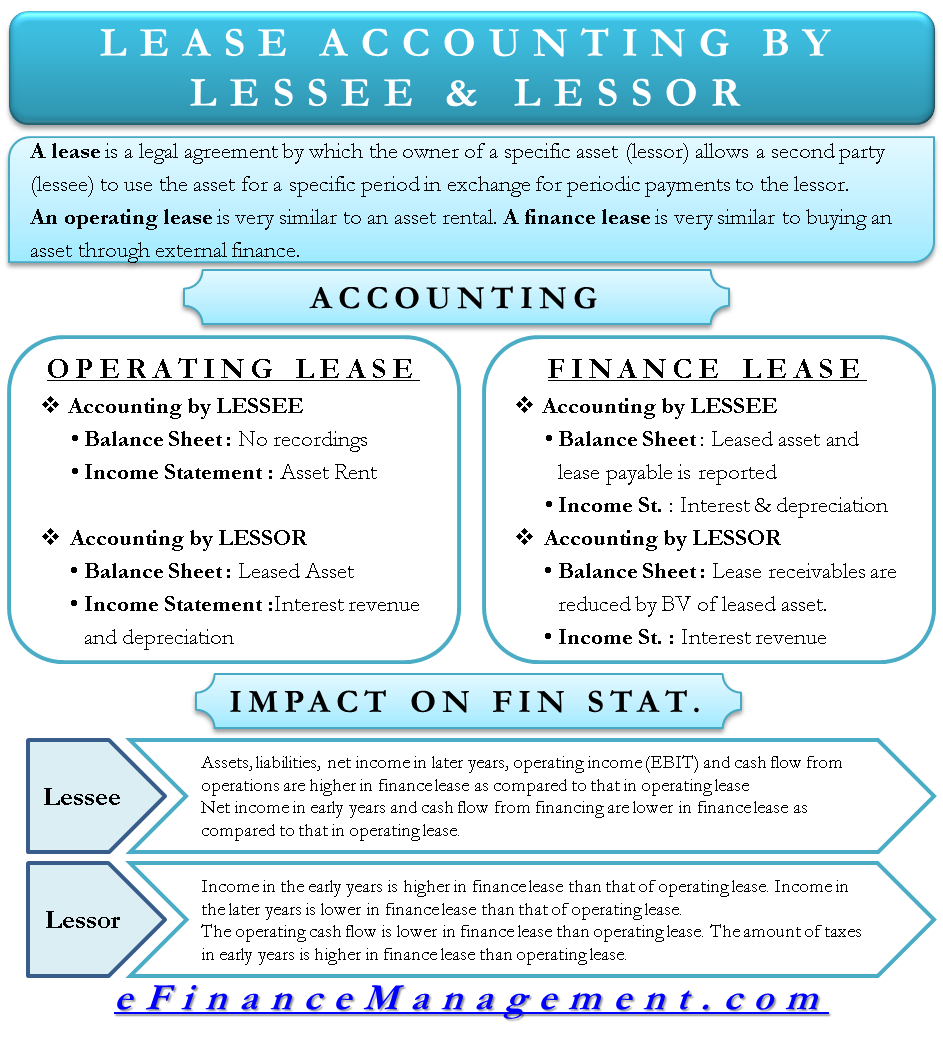

Lessor accounting model. The unearned account is treated as a contra-receivable. Operating Lease Accounting by Lessee. As commercial substance of finance lease is lie with the lessee due to transfer of risk and rewards of ownership the required accounting treatment will be. A Refresher On Accounting For Leases The Cpa Journal.

The Lessor is entitled to receive Royalty from the Lessee. Both leased asset and lease payable liability is reported. The ongoing amortization of the right-of-use asset The ongoing amortization of the interest on the lease liability Any variable lease payments that are not included in the lease liability. In each case the finance lease accounting journal entries show the debit and credit account together with a brief narrative. Lease Accounting Calculations And Changes Netsuite.

Source: journalofaccountancy.com

Source: journalofaccountancy.com

Whereas the royalty which is paid on the basis of sales is debited to the Profit Loss Ac. Or Gross Investment Un earned Finance income. The finance lease accounting journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of finance or capital leases. B In the Books of Lessee. Lessee Accounting For Governments An In Depth Look Journal Of Accountancy.

Source: efinancemanagement.com

Source: efinancemanagement.com

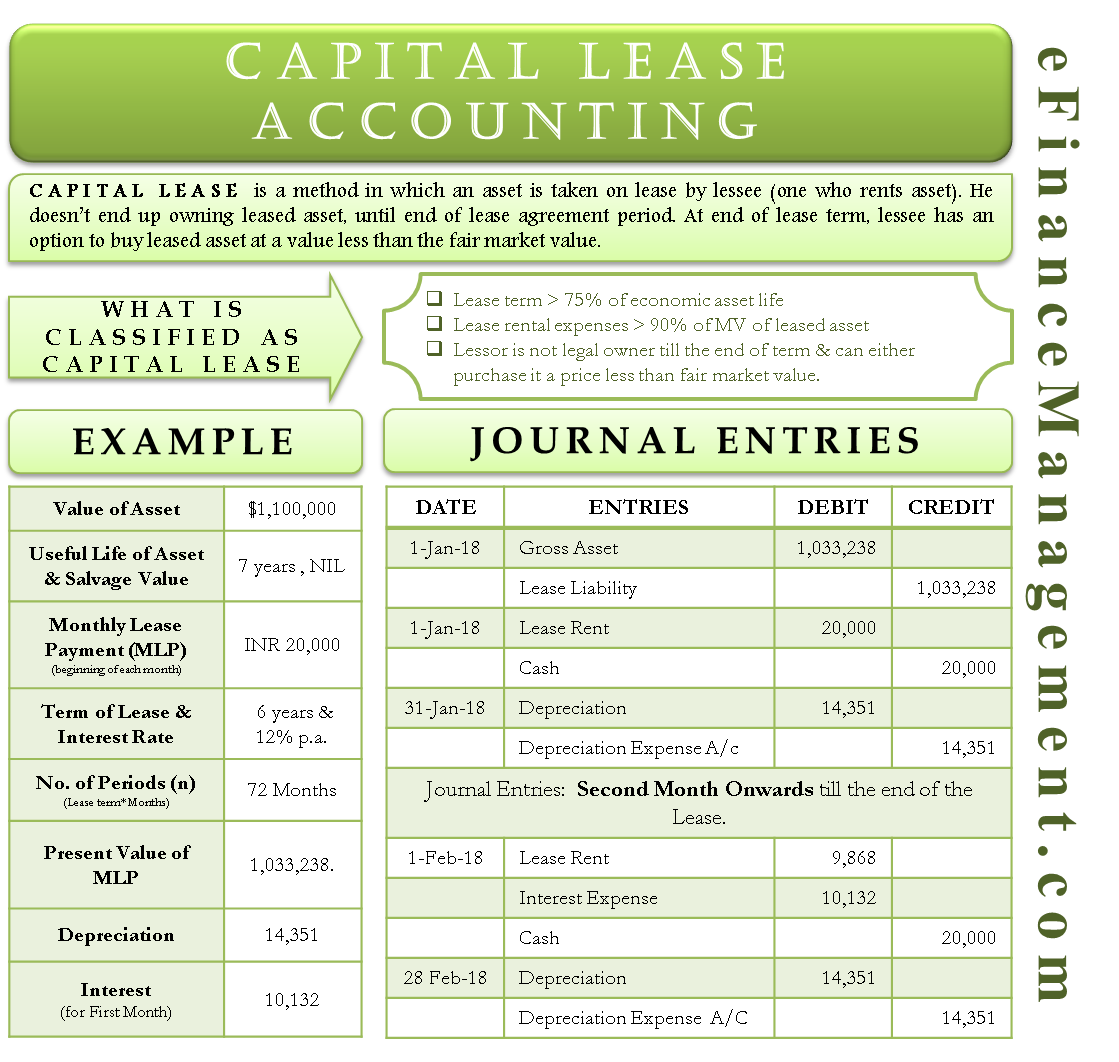

The main driver between operating and finance leases for lessors under IFRS 16 is transfer of ownership. Lease modifications are accounted for by the lessor as a new lease from the effective date of the modification considering any prepaid or accrued lease payments relating to the original lease as part of the lease payments for the new lease IFRS 1687. B In the Books of Lessee. Lessor accounting finance leases. Capital Lease Accounting With Example And Journal Entries.

Source: efinancemanagement.com

Source: efinancemanagement.com

Lease agreements where the lessor maintains ownership are operating leases. Record the assets as a non current asset in the lessees statement Present value of lease payments or Fair value whichever is lower. Lease accounting lessor financial lease treat as receivables operating lease treat as fixed asset and depreciation is to be charged lessee short tenure upto 12 months at the option of the lessee lease payments will be treated as expense long tenure recognised as right of use asset if lease transfers ownership or there is certainty of exercise. Recognises as receivables at amount equal to net investment. Lease Accounting Treatment By Lessee Lessor Books Ifrs Us Gaap.

Source: brieflyfinance.com

Source: brieflyfinance.com

Based on this ownership and usage pattern we describe the accounting treatment of an operating lease by the lessee and lessor. Operating Lease Accounting by Lessee. A lessee uses the leased asset and makes regular payments to the lessor. B In the Books of Lessee. Operating Vs Capital Leases Lessee And Lessor Perspective.

Source: studylib.net

Source: studylib.net

A lease should present assets taken under lease agreement in the category of finance lease by way of a footnote to the accounts. The accounting and reporting of different leases are as follows. Record the assets as a non current asset in the lessees statement Present value of lease payments or Fair value whichever is lower. Accounting Treatment of Leases. Leases Accounting As 19.

Source: cpajournal.com

Source: cpajournal.com

Whereas the royalty which is paid on the basis of sales is debited to the Profit Loss Ac. Accounting for a Finance Lease When a lessee has designated a lease as a finance lease it should recognize the following over the term of the lease. Finance lease in non-cancellable contract and also lessor is not responsible for any expenses and taxes of the leased asset. Because the lessee who controls the asset is not the owner of the asset the lessee may not exercise the same amount of care as if it were hisher own asset. A Refresher On Accounting For Leases The Cpa Journal.

Source: cost-management-financial-accounting.blogspot.com

Source: cost-management-financial-accounting.blogspot.com

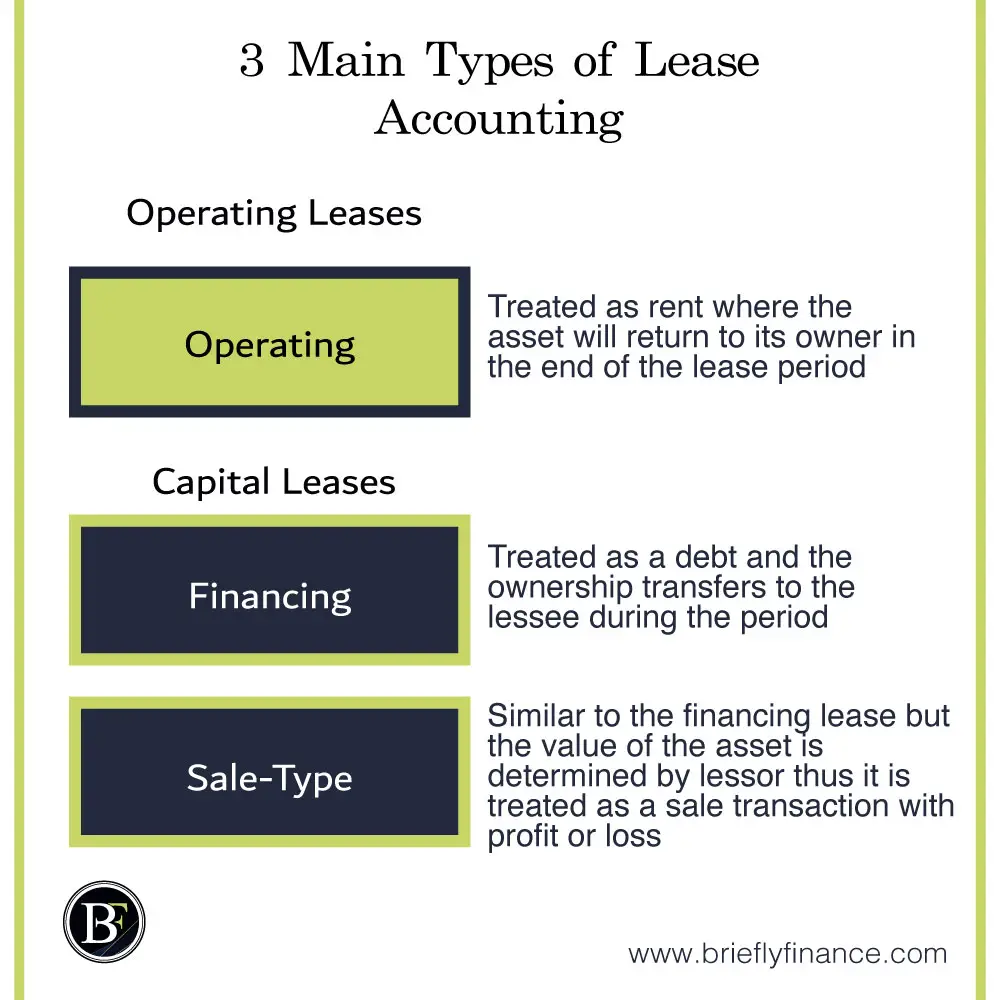

Lessors are required to determine if a lease is classified as an operating or finance lease and use the appropriate accounting treatment. Here royalty would be an income to the Lessor. Lessors are required to determine if a lease is classified as an operating or finance lease and use the appropriate accounting treatment. The lease receivable recognised by a lessor under a finance lease is a financial instrument and is subject to the derecognition and impairment provisions of IAS 39. Accounting Entries For Operating Leases With Case Study Example Learn Accounting Online.

Source: journalofaccountancy.com

Source: journalofaccountancy.com

Lease accounting lessor financial lease treat as receivables operating lease treat as fixed asset and depreciation is to be charged lessee short tenure upto 12 months at the option of the lessee lease payments will be treated as expense long tenure recognised as right of use asset if lease transfers ownership or there is certainty of exercise. As commercial substance of finance lease is lie with the lessee due to transfer of risk and rewards of ownership the required accounting treatment will be. Lessor accounting finance leases. For Receiving the amount of lease. Lessee Accounting For Governments An In Depth Look Journal Of Accountancy.

Source: slidetodoc.com

Source: slidetodoc.com

For total amount of lease receivables. The accounting and reporting of different leases are as follows. A lease is either. In each case the finance lease accounting journal entries show the debit and credit account together with a brief narrative. Lkas 17 Orientation Objective Scope Definition Classification Of.

Source: bdo.com.au

Source: bdo.com.au

Accounting Treatment of Leases. A lease should present assets taken under lease agreement in the category of finance lease by way of a footnote to the accounts. The Lessor is entitled to receive Royalty from the Lessee. For example rent received is of 5000 Lease. Ifrs 16 Is Business As Usual For Lessors But Creates Complexity For Subleasing Arrangements Bdo Australia.

Source: journalofaccountancy.com

Source: journalofaccountancy.com

A finance lease also called capital lease in the US GAAP in which the risks and rewards. In addition the difference between the lease payments and the assets cost is recorded immediately as unearned interest revenue. A finance lease also called capital lease in the US GAAP in which the risks and rewards. Lease modifications are accounted for by the lessor as a new lease from the effective date of the modification considering any prepaid or accrued lease payments relating to the original lease as part of the lease payments for the new lease IFRS 1687. Lessee Accounting For Governments An In Depth Look Journal Of Accountancy.

Source: bdo.com

Source: bdo.com

Lessor accounting utilizes the opposite concept - the exact value of all future lease payments are initially recorded as a lease receivable. Lease modifications are accounted for by the lessor as a new lease from the effective date of the modification considering any prepaid or accrued lease payments relating to the original lease as part of the lease payments for the new lease IFRS 1687. The accounting is based on whether significant risks and rewards incidental to ownership of an underlying asset are transferred to the lessee in which case the lease is classified as a finance lease. Recognises as receivables at amount equal to net investment. Lease Accounting A Guide For Tech Companies Bdo Insights.

Operating Lease Accounting by Lessee. As earlier stated if the finance lease is not in the nature of a conditional sale the lease shall be treated as an operating lease. Because the lessee who controls the asset is not the owner of the asset the lessee may not exercise the same amount of care as if it were hisher own asset. For total amount of lease receivables. Journal Entries Of Lease Accounting Education.