In My Books 1. When I will give Advance to My Employee Because I did not receive the service from my employee. Advance entry in cash book.

Advance Entry In Cash Book, It is generally best not to account for a customer advance with an automatically reversing entry since. How it is posted will depend on whether it is earned revenue part of the order has been fulfilled but no invoice supplied yet or unearned revenue the order will be fulfilled and invoiced at a later stage. Rent paid in advance ie. It is the online cash book for posting such transactions as a single screen entry in SAP.

Miracle Software New Brochure Corporate Stationery Business Card Design Stationery Design From pinterest.com

Miracle Software New Brochure Corporate Stationery Business Card Design Stationery Design From pinterest.com

Whether loan is given or loan is taken it is must to record it in books because given loan is our asset and taken loan is our liability. It is the online cash book for posting such transactions as a single screen entry in SAP. The benefits are due to be received in the future accounting period. Prepaid Rent is the amount of rent paid by a firm in advance but the related benefits equivalent to the amount of advance payment are yet to be received.

Lets assume that a valuable employees car requires an emergency repair of 800.

Read another article:

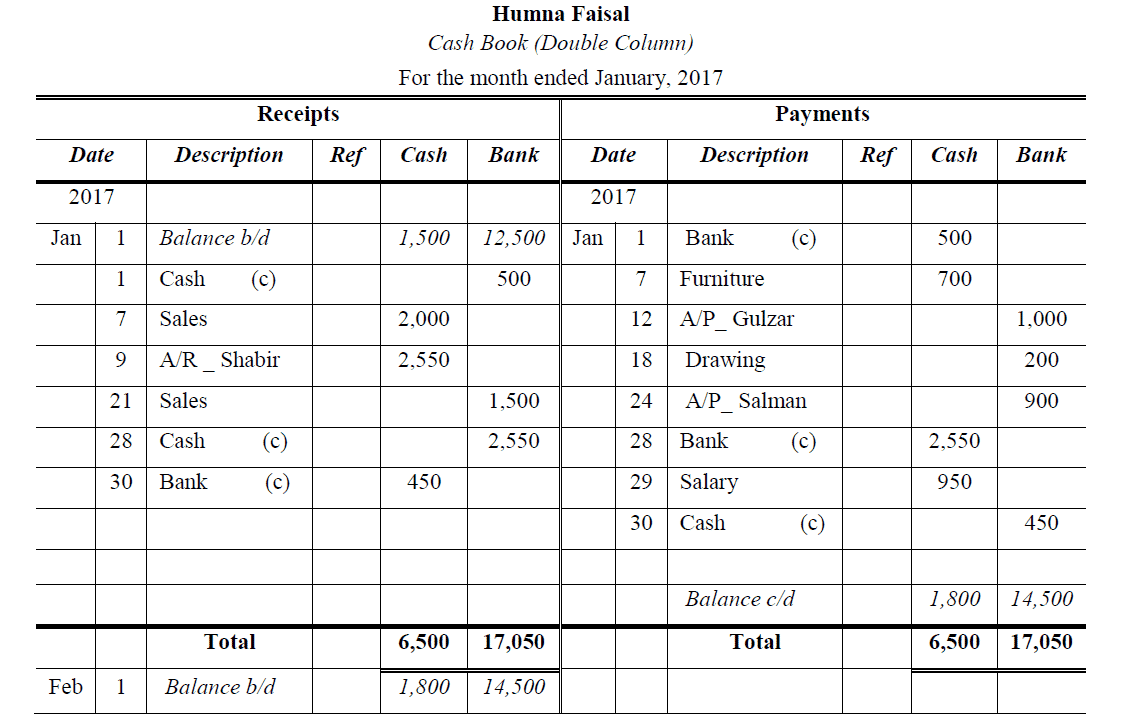

For example if ABC International issues a 1000 advance to employee Smith it may record the initial transaction as. Cr VendorPerson xxx 100. For example if ABC International issues a 1000 advance to employee Smith it may record the initial transaction as. Two column cash book. In offices where there are number of cases of advances it is better to open an advance register.

Source: pinterest.com

Source: pinterest.com

These are expenses but taken as an asset because the benefit from them is still due. Prepaid expenses are payments made in advance resulting into a right to receive compensation or a claim to use assets of another entity like prepaid insurance and prepaid rent. The following Cash Book examples provide an outline of the most common Cash Books. Cash Book is a journal for making primary entry of all cash transactions. Ultimate Daybook For Sellers Codelib App In 2021 Expense Management Electronic Shop Wise.

Source: double-entry-bookkeeping.com

Source: double-entry-bookkeeping.com

This is so because both aspects of the transaction appear in the cash book itself. It is also ledger wherein cash and bank accounts are maintained. Cr VendorPerson xxx 100. 2 Once settlement is done. Cash Advance Received From Customer Double Entry Bookkeeping.

Source: pinterest.com

Source: pinterest.com

So for knowing actual balance of loan outstanding we need to. Debit the customer advances liability account and credit the revenue account. Moreover on the basis of outstanding balance interest is calculated and it is paid by borrower to lender. Cash Book is a journal for making primary entry of all cash transactions. Rent Paid In Advance Entry In Accounting Equation P S Of Marketing Accounting Books Accounting.

Source: accountancyknowledge.com

Source: accountancyknowledge.com

Prepaid Rent is the amount of rent paid by a firm in advance but the related benefits equivalent to the amount of advance payment are yet to be received. When cash is paid into the bank the amount deposited is written on the left side in the bank column and at the same time the same amount is entered on the right side in the cash column. Prepaid Rent Accounting Entry Prepaid rent is an amount for rent which has been paid in advance. Prepaid Rent is the amount of rent paid by a firm in advance but the related benefits equivalent to the amount of advance payment are yet to be received. Three Column Cash Book Problems And Solutions Accountancy Knowledge.

Source: pinterest.com

Source: pinterest.com

Dr VendorPerson 100 xxxx. In an office where an account of banking nature PL account is in operation separate double column Cash Book. Debit the cash account and credit the customer advances liability account. Rent paid in advance example. Miracle Software New Brochure Corporate Stationery Business Card Design Stationery Design.

So I will record in my books. Cash income goes in the Revenue column and cash out goes in Expenditure. Enter the exact date as well as the opening balance of the previous day month or year. Dr Expenses 100 xxx. Bank Cash Book Notes Videos Qa And Tests Grade 10 Accountancy Bank Cash Book Kullabs.

Source: pinterest.com

Source: pinterest.com

When a company receives money in advance of earning it the accounting entry is a debit to the asset Cash for the amount received and a credit to the liability account. Two journal entries are involved. Receipts not entered 530 Error of original entry in cash book 650-560 90 620 47950 Less. A business has an annual office rent of 12000 and pays the landlord 3 months in advance on the first day of each quarter. A Cash Book Is A Financial Journal In Which Cash Receipts And Payments Including Bank Deposits And Withdrawals Are Recorded First I Accounting Notes Cash Books.

Source: fi.pinterest.com

Source: fi.pinterest.com

For example on December 29 2020 the company ABC pays the 30000 rent in advance for 6 months for the office rent from January 2021 to June 2021. Any increase in my asset will be debit in my own books. It is generally best not to account for a customer advance with an automatically reversing entry since. Accounting Entries of Advance to Employee. Sat March 19th The Reed Band Reforms For An Evening Of Rock N Roll Covers In Support Of Charity Smile Train Uk Free Entry Cash Donati Barge Band Supportive.

Source: pinterest.com

Source: pinterest.com

No matter what method is later used to repay the company - a check from the employee or payroll deductions - the entry. 1 When Advance is given. Cash Book is a journal for making primary entry of all cash transactions. A day book-cum-ledger kept for making entry of the cash transactions as well as posting to the cash and bank accounts is called Cash Book. Options Trading Journal Spreadsheet Download Weddings Jewelry Rings Weddings Jewelry Rings Excel Template Label Templates Printable Worksheets.

Source: accountancyknowledge.com

Source: accountancyknowledge.com

Prepaid Rent is the amount of rent paid by a firm in advance but the related benefits equivalent to the amount of advance payment are yet to be received. TYPES OF CASH BOOK Cash book can be of four types. All the transaction which is recorded in the cash book has the two. Prepaid Rent Accounting Entry Prepaid rent is an amount for rent which has been paid in advance. Double Column Cash Book Accountancy Knowledge.

Source: id.pinterest.com

Source: id.pinterest.com

Grewal Double Entry Book Keeping 144. The following Cash Book examples provide an outline of the most common Cash Books. Lets assume that a valuable employees car requires an emergency repair of 800. How it is posted will depend on whether it is earned revenue part of the order has been fulfilled but no invoice supplied yet or unearned revenue the order will be fulfilled and invoiced at a later stage. Grab Our Fresh And Qualified Merchant Cash Advance Leads Free Trial Lead Generation Digital Marketing Agency Digital Marketing Services.

Source: pinterest.com

Source: pinterest.com

Receipts not entered 530 Error of original entry in cash book 650-560 90 620 47950 Less. Two journal entries are involved. In this case the company ABC can make the journal entry for the rent paid in advance on December 29 2020 as below. I Statement adjusting cash book balance as at 311083 Balance per cash book 47330 11 Advanced Level Add. Four Types Of Adjusting Entries Accounting Basics Accounting And Finance Accounting Help.

Source: pinterest.com

Source: pinterest.com

2 Once settlement is done. 2 Once settlement is done. If the cash advance is repaid through payroll withholdings the amount withheld will be recorded as a credit to Advance to Employees. Two column cash book. Accounts That Can Be Adjusted Accrued Revenues Accrued Expenses Deferred Expenses And Deferred Revenues Accounting Principles Accounting Mo Money.

Source: ar.pinterest.com

Source: ar.pinterest.com

It is the online cash book for posting such transactions as a single screen entry in SAP. When I will give Advance to My Employee Because I did not receive the service from my employee. With the help of cash book cash and bank balance can be checked at my point of time. For example on December 29 2020 the company ABC pays the 30000 rent in advance for 6 months for the office rent from January 2021 to June 2021. Wordpress Error Restaurant Oslo Enjoyment.

Source: pinterest.com

Source: pinterest.com

Two journal entries are involved. Lets assume that a valuable employees car requires an emergency repair of 800. TYPES OF CASH BOOK Cash book can be of four types. When a company receives money in advance of earning it the accounting entry is a debit to the asset Cash for the amount received and a credit to the liability account. A Journal Entry Is The First Step Of The Accounting Or Book Keeping Process In This Step All The Accounting Transactions A Accounting Journal Entries Journal.