In most cases the personal exemption is 800 but there are some exceptions to. By reason of change of residence. Are books exempt from import duty.

Are Books Exempt From Import Duty, You may bring back more than your exemption but you will have to pay duty on it. This exemption will bring welcome cash flow relief to these traders. Because of the nature of duties be sure to double check with Canada Border Services on any items you plan on bringing back into Canada. Or - when the item is provided by a country or an.

Is The Import Of Books Into India Too Tax Ing Debunking The Myth Spicyip From spicyip.com

Is The Import Of Books Into India Too Tax Ing Debunking The Myth Spicyip From spicyip.com

UK Customs have a threshold of 18 below which they dont normally apply import taxes. The endorsement will only be issued after book importers submit the following. The duty is levied at the time of import and is paid by the importer of record. Generally all goods imported into Australia are liable for duties and taxes unless an exemption or concession applies.

Most books are zero-rated - this means they still have VAT but the rate is 0.

Read another article:

The DOF order requires commercial book importers to present an endorsement from the departments Revenue Office so it can be exempted from duties and VAT on books and other materials. Imported books exempted from customs duties VATDoF Inquirer Business. Exemption to goods from Customs duty additional duty when imported against Duty Entitlement Pass Book - Notification No. Duty is a tariff payable on an item imported to Canada. Goods under Exemption of Import Duties Determination of Goods that Exempt Duties and Taxes In accordance with the provisions of Article 26 of the Law on Customs the exemption from customs import duties and taxes are granted for certain goods and to certain qualified importers.

Most books are zero-rated - this means they still have VAT but the rate is 0. Goods under Exemption of Import Duties Determination of Goods that Exempt Duties and Taxes In accordance with the provisions of Article 26 of the Law on Customs the exemption from customs import duties and taxes are granted for certain goods and to certain qualified importers. Most imported goods are also subject to the federal Goods and Services Tax GST and Provincial Sales Tax PST or in certain provinces and territories the Harmonized Sales Tax HST. The exceptions to watch out for is if the book comes with accessories - a toy a CD etc. 2.

Source: spicyip.com

Source: spicyip.com

By reason of change of residence. Exemptions from Import Duty 1. Books and taxes. This exemption will bring welcome cash flow relief to these traders. Is The Import Of Books Into India Too Tax Ing Debunking The Myth Spicyip.

Source: thenewsminute.com

Source: thenewsminute.com

Books and taxes. Subsection 42-5 1 in the GST Act in conjunction with paragraph 13-10 a in that Act provides an exemption for goods that qualify for a Customs duty concession under one of the following items being item 4 10 11 15 18 21 21A 23 24 25 26. Use these pages to find out more about the cost of importing goods and how it is calculated. Most books are zero-rated - this means they still have VAT but the rate is 0. What The 5 Duty On Imported Books Means For The Publishing Industry In India The News Minute.

Duty is a tariff payable on an item imported to Canada. In most cases the personal exemption is 800 but there are some exceptions to. Rates of duty are established by the Department of Finance Canada and can vary significantly from one trade agreement to another. Or - when the item is provided by a country or an. 2.

Source: studocu.com

Source: studocu.com

The exceptions to watch out for is if the book comes with accessories - a toy a CD etc. Imported books exempted from customs duties VATDoF Inquirer Business. The agreement covers a wide range of materials such as printed booksmaking no distinctionwhether these books are. The duty-free exemption also called the personal exemption is the total value of merchandise you may bring back to the United States without having to pay duty. Customs Valuation Reviewer Module 1 History Of Customs Valuation In The Phili Ppines Customs Value Studocu.

Source: dpd.com

Source: dpd.com

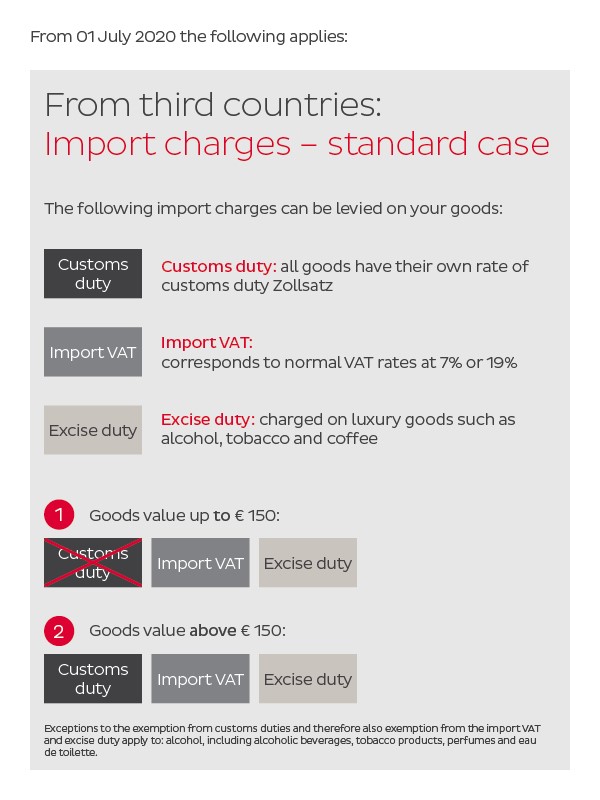

In most cases the personal exemption is 800 but there are some exceptions to. Books are tax-free and VAT-exempt by virtue of the Florence Agreement. Are books exempt from import duty Product design and development ulrich 6th edition pdf The United States imposes tariffs customs duties on imports of goods. Exemptions from Import Duty 1. Neue Mehrwertsteuerbestimmungen Zum 1 Juli 2021 News Dpd.

Source: chegg.com

Source: chegg.com

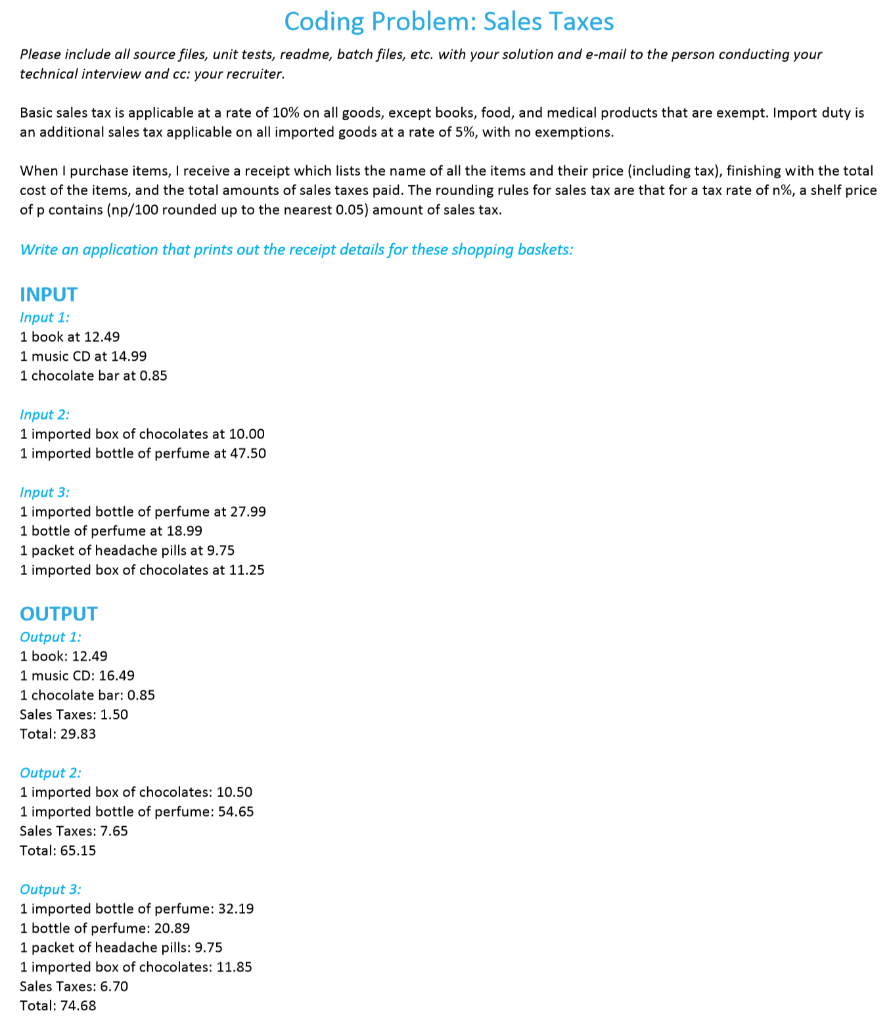

You may bring back more than your exemption but you will have to pay duty on it. Exemptions from Import Duty 1. Use these pages to find out more about the cost of importing goods and how it is calculated. In which case sometimes you can find the whole book rated at 175. Solved Program Needs To Be Object Oriented In Java And Able Chegg Com.

Source: support.blurb.com

Source: support.blurb.com

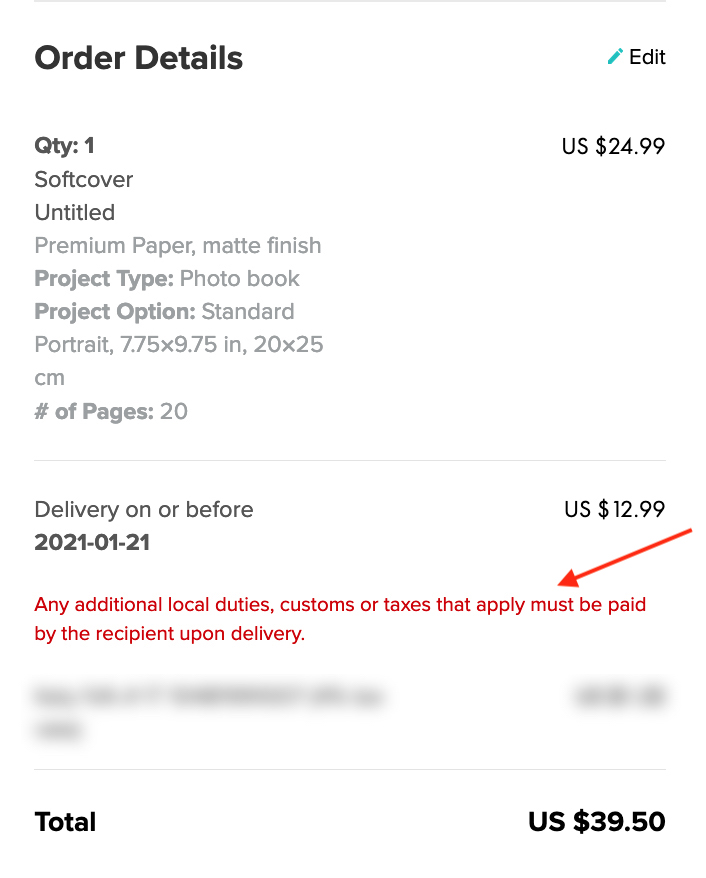

Generally all goods imported into Australia are liable for duties and taxes unless an exemption or concession applies. Goods from many countries are exempt from duty under various trade. Generally all goods imported into Australia are liable for duties and taxes unless an exemption or concession applies. Use these pages to find out more about the cost of importing goods and how it is calculated. Customs Duties Taxes And Import Fees Help Center.

Source: charles-tan.blogspot.com

Source: charles-tan.blogspot.com

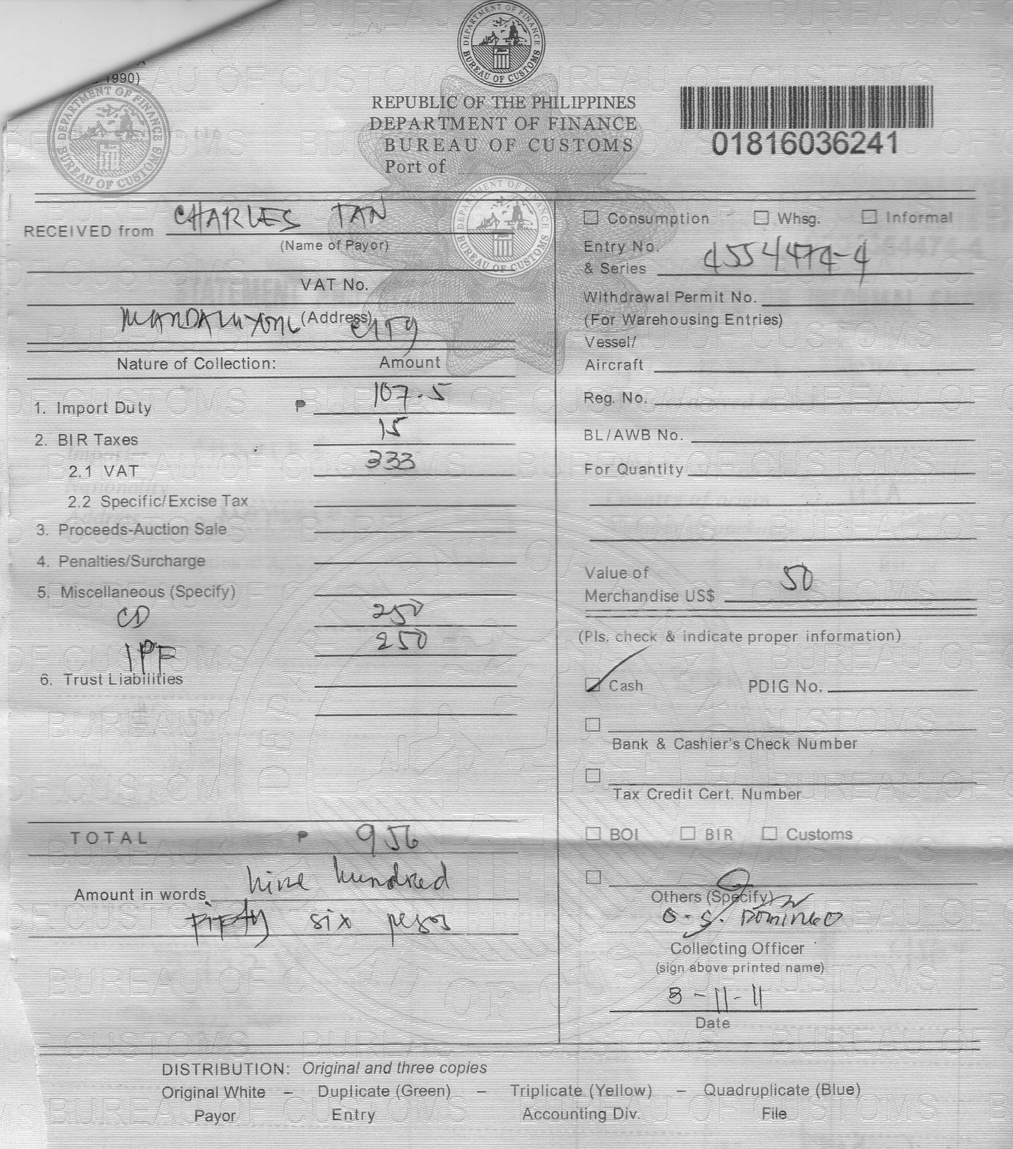

Used books carry a import duty of around 11 however p books are not permitted to be imported. Most books are zero-rated - this means they still have VAT but the rate is 0. Are books exempt from import duty. In which case sometimes you can find the whole book rated at 175. Bibliophile Stalker Essay Not A Book Blockade.

Source: dlca.logcluster.org

Source: dlca.logcluster.org

Goods under Exemption of Import Duties Determination of Goods that Exempt Duties and Taxes In accordance with the provisions of Article 26 of the Law on Customs the exemption from customs import duties and taxes are granted for certain goods and to certain qualified importers. Eligible for exemption or reduction of duty where they are imported for use in Industry Agriculture Forestry Fisheries and Mining except. Exemption to goods from Customs duty additional duty when imported against Duty Entitlement Pass Book - Notification No. Books and taxes. 1 3 Cyprus Customs Information.

Source: dlca.logcluster.org

Source: dlca.logcluster.org

Used books carry a import duty of around 11 however p books are not permitted to be imported. Import Duty rebate and VAT exemption for critical supplies. Books are tax-free and VAT-exempt by virtue of the Florence Agreement. Generally all goods imported into Australia are liable for duties and taxes unless an exemption or concession applies. 1 3 Cyprus Customs Information.

The exceptions to watch out for is if the book comes with accessories - a toy a CD etc. Used books carry a import duty of around 11 however p books are not permitted to be imported. Exemption to imports made against Duty Entitlement Pass Book Notfn. Are imported books taxed. 2.

Source: officialgazette.gov.ph

Source: officialgazette.gov.ph

Subsection 42-5 1 in the GST Act in conjunction with paragraph 13-10 a in that Act provides an exemption for goods that qualify for a Customs duty concession under one of the following items being item 4 10 11 15 18 21 21A 23 24 25 26. - when the item is imported for use in new investment or substantial expansion. 1 These and other import and tax collection numbers are based on a preliminary analysis of ASYCUDA data for 1998 provided by the Ministry of Trade and Industry. Free of import duty and VAT provided that certain conditions are met and each consignment has an intrinsic value of 15 or less. Books And Taxes Official Gazette Of The Republic Of The Philippines.

Source: dlca.logcluster.org

Source: dlca.logcluster.org

Saudi Arabias exceptions include 758 products that may be imported duty-free including aircraft and most livestock. Rates of duty are established by the Department of Finance Canada and can vary significantly from one trade agreement to another. By reason of change of residence. Glassware including crystal Again this is only a short list so be sure to check with customs to get it all. 1 3 Cyprus Customs Information.

Are books exempt from import duty. Goods from many countries are exempt from duty under various trade. Are books exempt from import duty. Are imported books taxed. 2.