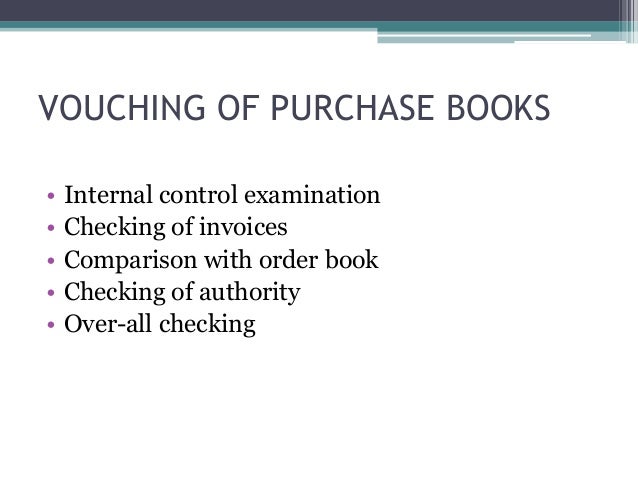

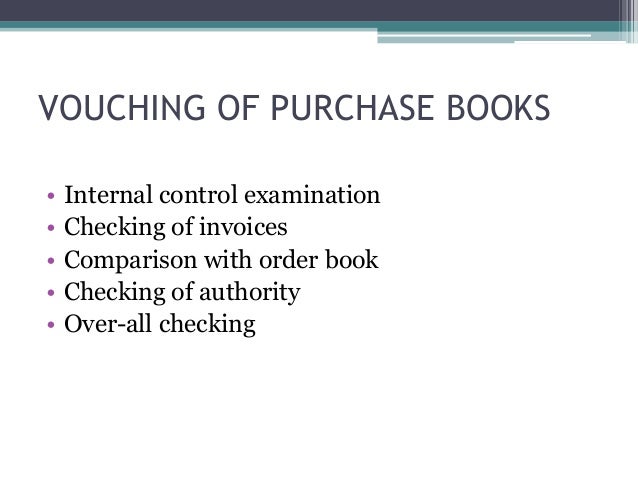

10 and surcharge is 10 which is calculated on Rs. The main objective of vouching purchase book is to ensure that all the goods purchased during the year are being received and the client makes payment only for the goods being delivered by the supplier. Vouching of purchase book.

Vouching Of Purchase Book, The main objective of vouching purchase book is to ensure that all the goods purchased during the year are being received and the client makes payment only for the goods being delivered by the supplier. When the goods are returned the suppliers account should be debited. Vouching of Purchase Book. Understand the production process.

Vouching Of Subsidiary Books From slideshare.net

Vouching Of Subsidiary Books From slideshare.net

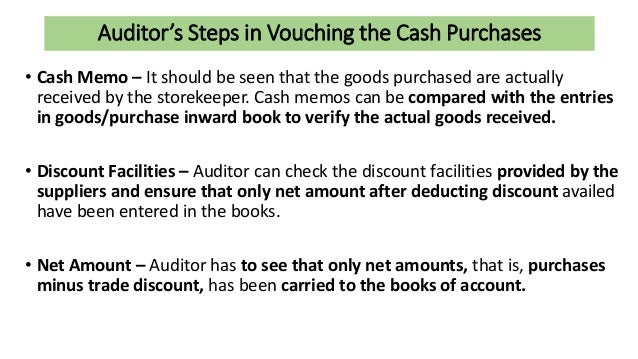

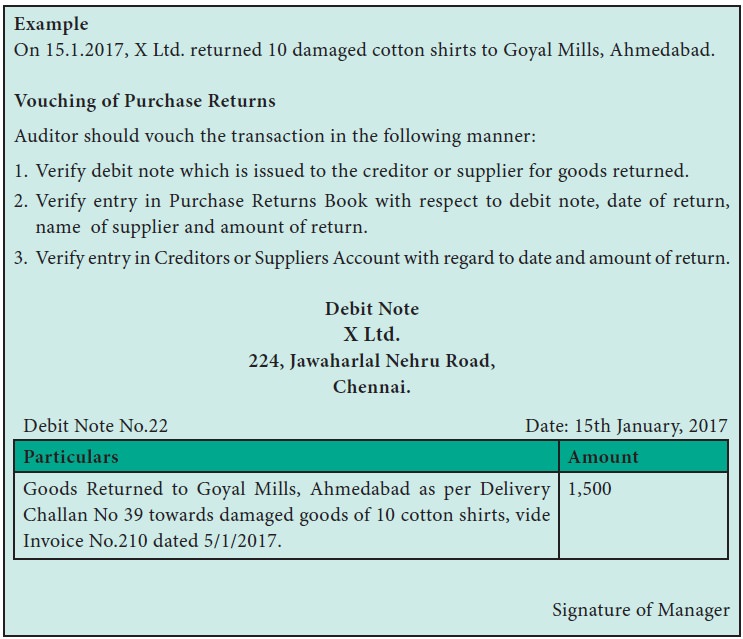

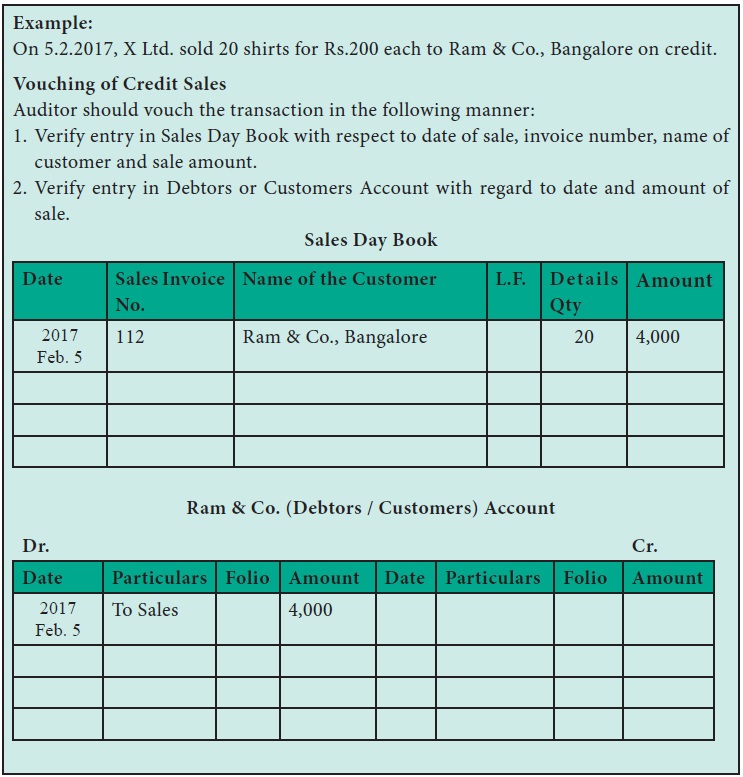

The auditor should check whether a debit note has been sent to the supplier or credit note has been received from the supplier. For the vouching of sales return book following techniques to be followed. Brief note on Purchase vouching 1. Vouching of Cash Payments Credit Side of Cash Book All the payment made to creditors expenses incurred in cash and all other payments done appear on the credit side of cash book and the Auditor is required to vouch cash payments because chances of cash misappropriation are very high.

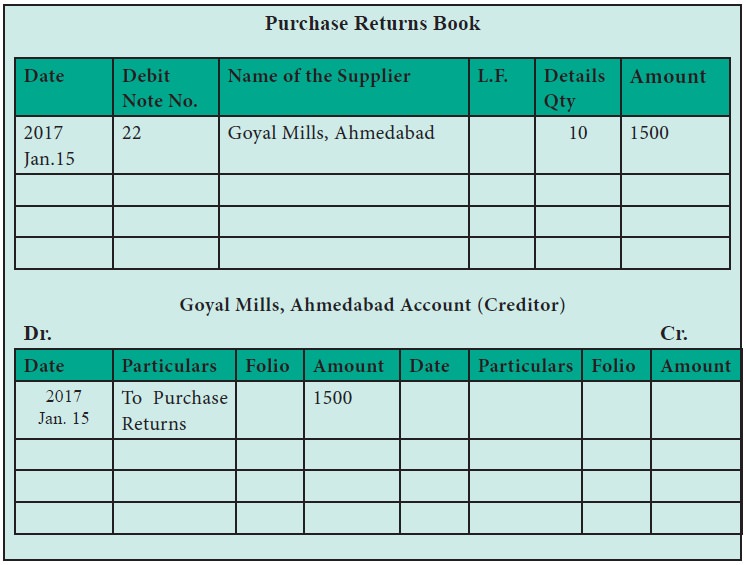

The debit is made through the purchase returns book on the basis of a Debit Note.

Read another article:

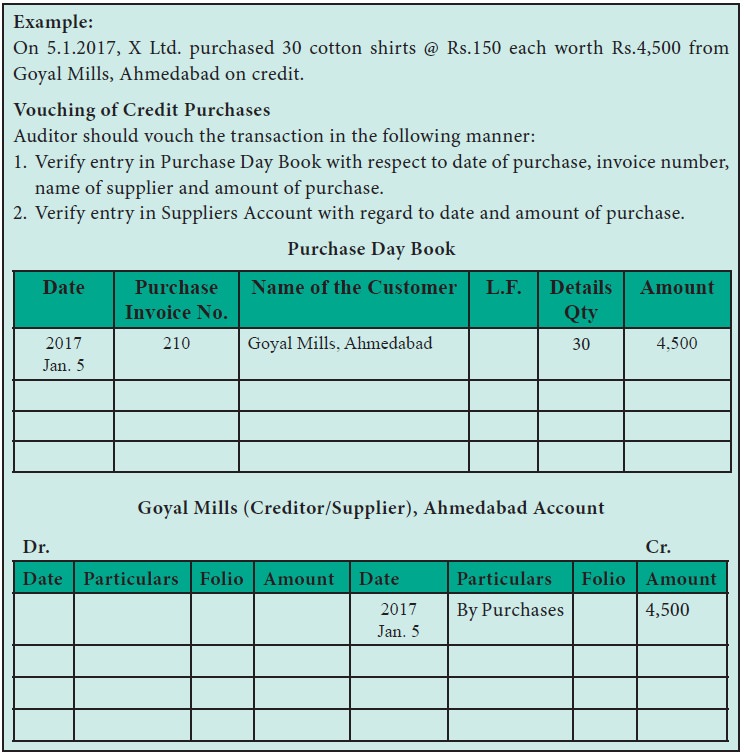

Vouching of Purchase Book. Following points show the importance of vouching. Similarly vouching is base of all auditing process. Vouching of Credit Purchases. Purchase vouching Check cash memo issued by supplier.

Source: pinterest.com

Source: pinterest.com

The auditor before vouching the purchase. Auditor will confirm whether return goods are posted in the sales return book. Goods inward book should be checked. Transactions relating to credit purchases are recorded in Purchase Book. Ansel Adams The Camera Book In 2021 The Incredibles Books Ansel Adams.

Source: slideshare.net

Source: slideshare.net

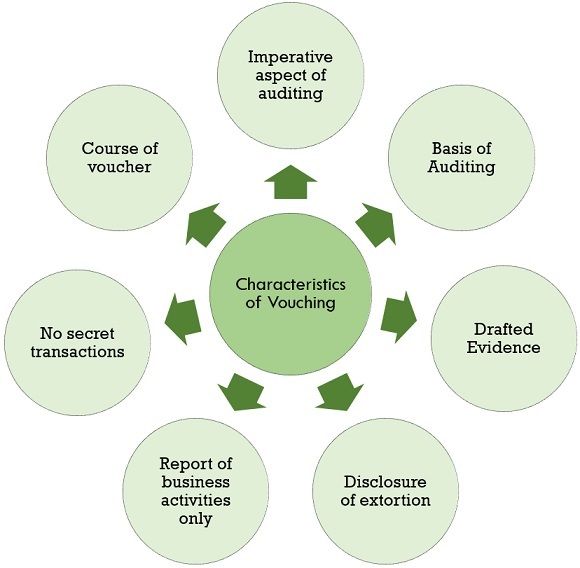

If he is satisfied with the system of internal check the auditor should proceed to vouch the Purchases Returns Book in the following manner. The debit is made through the purchase returns book on the basis of a Debit Note. Vouching of Purchase Book. Vouching is equally important as passing of original entry in the books of accounts. Vouching Of Subsidiary Books.

Source: slideshare.net

Source: slideshare.net

Purchase invoice must be a Tax Invoice otherwise buyer cant avail input tax credit of vat. If original entry is wrong it will affect every process of accounting entry and its impact will be till the end result. The auditor before vouching the purchase. Vouching is a procedure followed in the process of the audit to authorise the credibility of the entries entered in the books of accounts. Unit 4 Vouching.

Source: brainkart.com

Source: brainkart.com

In simple and easier words it is a precise investigation of the presented documents of the firm by an auditor to check the correctness and accuracy of such documents. Profit on sale on hire-purchase should be duly calculated on the basis of installment received during the year. After the books of original entries have been vouched and pasting there from fully checked the following further steps should be taken in connection with the audit the purchases ledger which is also called Sundray creditors ledger or accounts payable ledger. 2 Cash purchases The vouching of the cash purchases should be on the following lines. Vouching Of Purchase Returns Auditing.

Source: slideshare.net

Source: slideshare.net

Similarly vouching is base of all auditing process. The date mentioned in the invoice relates to the period under audit. It is the technique followed in an audit for establishig authenticity of the transactions recorded in the primary books of accounts. Purchase vouching Check cash memo issued by supplier. Vouching Of Subsidiary Books.

Source: pinterest.com

Source: pinterest.com

The main objective of vouching of Purchases Book is to see that all purchase invoices are entered in the Purchases Book and the goods entered in the Purchases Book are actually received by the business and the client pays money only for those goods that are delivered by the supplier to him. Purchase invoice must be a Tax Invoice otherwise buyer cant avail input tax credit of vat. The main objective of vouching purchase book is to ensure that all the goods purchased during the year are being received and the client makes payment only for the goods being delivered by the supplier. Following points show the importance of vouching. 15 Tips To Find Cheap Flight Tickets Is It Cheaper Flying On A Wednesday Or To Purchase The Tickets On A Tue Flight Ticket Cheap Flights Cheap Flight Tickets.

Source: es.pinterest.com

Source: es.pinterest.com

Study of the Hire-Purchase agreement for hire-purchase-sale price number of installment rate of interest etc. We will further discuss the main duties of an Auditor concerning the vouching of credit purchases. The auditor before vouching the purchase. The invoice is prepared in the name of the client. Pin On Inspired.

Source: brainkart.com

Source: brainkart.com

It is the technique followed in an audit for establishig authenticity of the transactions recorded in the primary books of accounts. Purchase invoice must be a Tax Invoice otherwise buyer cant avail input tax credit of vat. If he is satisfied with the system of internal check the auditor should proceed to vouch the Purchases Returns Book in the following manner. Vouching is equally important as passing of original entry in the books of accounts. Vouching Of Credit Purchases Auditing.

Source: pinterest.com

Source: pinterest.com

Verify which document is executed for requisition of Material. With every purchase invoice a Purchase order and Goods receipt note should be enclosed. Take a list of Authorised persons who can order goods or material. 3 Sometimes invoices are suppressed to manipulate accounts and purchase shown at less figures than the actual Goods Inward Book and the Stock Sheets with the purchases Book specially for goods received during the last two or three weeks of a financial year and during a few weeks of the beginning of the next financial yearBCom 3rd Year Vouching in Auditing Notes Study Material. Vouching Of Cash Receipts General Guidelines To Auditors Youtube Receipts Guidelines Auditor.

Source: pinterest.com

Source: pinterest.com

VOUCHING OF CASH TRANSACTIONS Vouching of cash receipts Opening Balance of Cash Book Opening balance of cash book represents cash in hand at the start of the year and. Following points show the importance of vouching. How would you vouch a purchase book. 2 Cash purchases The vouching of the cash purchases should be on the following lines. Zodiac Constellation Poster Sb Shop Constellations Constellation Poster Pisces Constellation.

Source: brainkart.com

Source: brainkart.com

Vouching of Purchase Returns Goods returned by the client to the suppliers due to poor quality defective goods and goods not according to the sample are recorded in the Purchase Returns Book. The major purpose behind the vouching of purchase book is to confirm that every purchase bill is entered in purchase book and the invoices entered in purchase book are against the actually received goods and payment is made for those actual purchases. The date mentioned in the invoice relates to the period under audit. Auditor will check relevant credit notes. Vouching Of Credit Sales Auditing.

Source: pinterest.com

Source: pinterest.com

Verify which document is executed for requisition of Material. How would you vouch a purchase book. Study of the Hire-Purchase agreement for hire-purchase-sale price number of installment rate of interest etc. If he is satisfied with the system of internal check the auditor should proceed to vouch the Purchases Returns Book in the following manner. Audit Findings Report Template 4 Professional Templates.

Source: theinvestorsbook.com

Source: theinvestorsbook.com

Purchase vouching Check cash memo issued by supplier. If he is satisfied with the system of internal check the auditor should proceed to vouch the Purchases Returns Book in the following manner. The auditor should check whether a debit note has been sent to the supplier or credit note has been received from the supplier. For vouching of Purchase 1st you have to understand the system of company. What Is Vouching Definition Types Sources Objectives And Importance The Investors Book.

Source:

Source:

In simple and easier words it is a precise investigation of the presented documents of the firm by an auditor to check the correctness and accuracy of such documents. After the books of original entries have been vouched and pasting there from fully checked the following further steps should be taken in connection with the audit the purchases ledger which is also called Sundray creditors ledger or accounts payable ledger. How would you vouch a purchase book. Profit on sale on hire-purchase should be duly calculated on the basis of installment received during the year. Hqayq71k7qru7m.

Source: brainkart.com

Source: brainkart.com

The auditor should check whether a debit note has been sent to the supplier or credit note has been received from the supplier. The auditor should examine entries in the cash book with the help of cash memos or invoices issued by the supplier and also goods inward book. All the payment made to creditors expenses incurred in cash and all other payments done appear on the credit side of cash book and the Auditor is required to vouch cash. Vouching of Cash Payments Credit Side of Cash Book All the payment made to creditors expenses incurred in cash and all other payments done appear on the credit side of cash book and the Auditor is required to vouch cash payments because chances of cash misappropriation are very high. Vouching Of Purchase Returns Auditing.