It is sometimes referred to as adjusted cost base (acb) as well. I've been watching for a few months, and it looks like td calculates this correctly:

Acb Book Value, If you want a good idea of what kind of returns you are really getting, you need to figure out your adjusted cost base. Cost or book value is total amount paid to purchase a security, including any transaction charges related to the purchase, adjusted for reinvested distributions, returns of capital and corporate reorganizations. The market value, in order to determine how much money was made or lost in their account over a given period.

How does adjusted cost base (acb) work? This is the same definition of an investment’s adjusted cost base (or acb). I�ve been watching for a few months, and it looks like td calculates this correctly: Book value the book value of a stock is theoretically the amount of money that would be paid to shareholders if the company was liquidated and paid off all of its liabilities.

Quote Acb ShortQuotes.cc

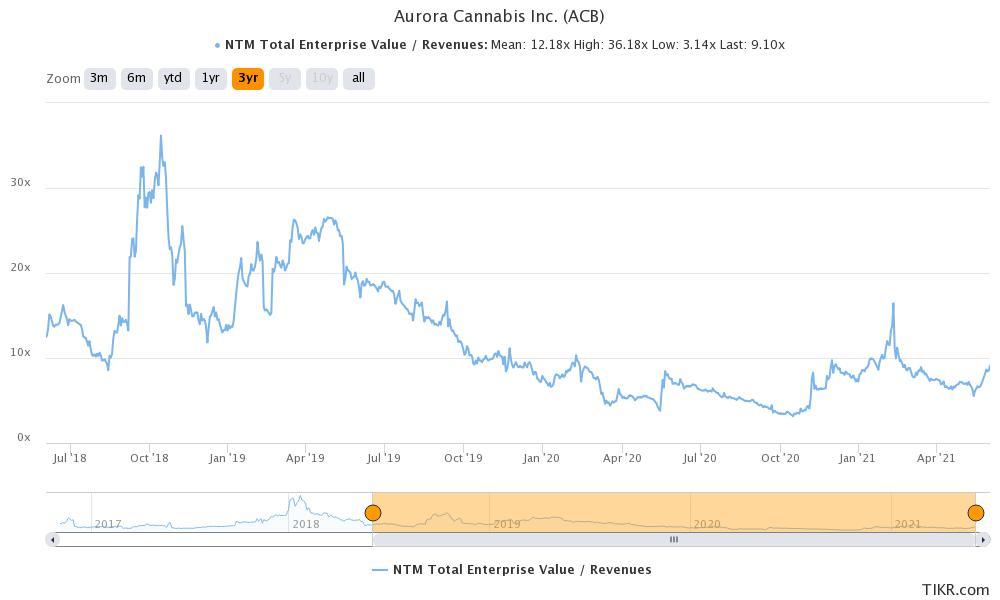

(book value is defined as total assets minus liabilities, preferred stocks, and intangible assets. When investors view their account statement, a common misconception is to compare the difference between the “book value” (also known as adjusted cost base, or “acb”) of their portfolio vs. It is used in calculating the capital gain or loss resulting from the sale of securities or mutual funds in a taxable portfolio. In a formula, book value looks like this: The book value refers to the total cost of the shares (ie shares x acb). Aurora cannabis price to book value:

ACB Ngân hàng TMCP Á Châu kì vọng khả quan 2021 Chứng, Aurora cannabis price to book value: The book value refers to the total cost of the shares (ie shares x acb). I�ve been watching for a few months, and it looks like td calculates this correctly: Let�s assume company xyz buys a factory building for $1,000,000. It is sometimes referred to as adjusted cost base (acb) as well.

ACB Aurora Cannabis Inc, Stock Quote, Analysis, Rating, And, perhaps more importantly, the cra requires this calculation to be used for income taxes in. In a formula, book value looks like this: Minus the distributions’ return of capital component. The market value, in order to determine how much money was made or lost in their account over a given period. Book value the book value of a stock.

Easier than ACB Canadian Portfolio Manager Blog, As a result, the book value equals the difference between a company’s total assets and total liabilities. It is sometimes referred to as adjusted cost base (acb) as well. How does adjusted cost base (acb) work? If you want a good idea of what kind of returns you are really getting, you need to figure out your adjusted cost base..

Example 3 Consider ACB, AB = 29, BC = 21 and angle ABC, How does adjusted cost base (acb) work? Find out all the key statistics for aurora cannabis inc. (book value is defined as total assets minus liabilities, preferred stocks, and intangible assets. Aurora cannabis book value per share from 2017 to 2021. Aurora cannabis�s book value per share for the quarter that ended in sep.

The Thieves of Pudding Lane (ACB Originals) Fruugo US, When transferring to another account, do you use the adjusted cost base (acb) or the market value? Book value, also known as adjusted cost base (acb), is calculated by adding the total amount of contributions made by an investor into a mutual fund, plus reinvested fund distributions, minus any withdrawals. 2) if it is an interlisted stock and you had.

ACB Stock Price and Chart — TSXACB — TradingView — India, By dividing book value by the total number of shares outstanding, you can find book value per share. All of the acb calculations should be done at the fund level and represented in the book value. Aurora cannabis price to book value: Book value (also known as adjusted cost base or acb) is the original or purchase price of an.

Understanding Book Value, Adjusted cost base (acb) is an income tax term that refers to an adjustment in an asset �s book value resulting from the cost of improvements, payouts, and similar improvements or dispositions. By dividing book value by the total number of shares outstanding, you can find book value per share. Aurora cannabis price to book value: Aurora cannabis price to.

ACB Ltd Value Open Faced ID Card Holders PINK (Pack of 5, Reported book value vs adjusted cost base. However, for most mutual funds, the current book value listed on an account statement will not be the same as the original investment. Compare acb with other stocks (acb.to), including valuation measures, fiscal year financial statistics, trading record, share statistics and more. The price to book ratio or p/b is calculated as market.

Panasonic BGACB Barry Greens Book on the AC130/AC160, Book value (also known as adjusted cost base or acb) is a concept that is often confusing to investors. 1) if this stock was transferred in to your current brokerage from somewhere else, it may not be correct unless you provided your current brokerage with the correct book value. Acb is good value based on its book value relative to.

ACB Stock Price and Chart — TSXACB — TradingView, Aurora cannabis book value per share from 2017 to 2021. (acb.to), including valuation measures, fiscal year financial statistics, trading record, share statistics and more. Average cost is the book cost divided by the current number of shares. When investors view their account statement, a common misconception is to compare the difference between the “book value” (also known as adjusted cost.

Quote Acb ShortQuotes.cc, This is because the book value of a mutual fund will change 1) if this stock was transferred in to your current brokerage from somewhere else, it may not be correct unless you provided your current brokerage with the correct book value. When you transfer shares to other accounts at another institution, you provide them with the book value. Book.

Example 3 Consider ACB, AB = 29, BC = 21 and angle ABC, (book value is defined as total assets minus liabilities, preferred stocks, and intangible assets. Book value and market value what is book value? Minus the distributions’ return of capital component. When investors view their account statement, a common misconception is to compare the difference between the “book value” (also known as adjusted cost base, or “acb”) of their portfolio vs..

Acb Stock Price Today / Aurora Cannabis Isn T Worth Zero, The market value, in order to determine how much money was made or lost in. When buying additional shares, for a stock split, for a. Let�s assume company xyz buys a factory building for $1,000,000. The act of transferring shares doesn’t change the cost of your shares. An adjusted cost base (acb) is an income tax term that refers to.

ACB Stock Price and Chart — NASDAQACB — TradingView, Cost or book value is total amount paid to purchase a security, including any transaction charges related to the purchase, adjusted for reinvested distributions, returns of capital and corporate reorganizations. T5008 may or may not show the acb. Book value the book value of a stock is theoretically the amount of money that would be paid to shareholders if the.

Should You Buy Aurora Cannabis (ACB) Stock Now and Bet on, By dividing book value by the total number of shares outstanding, you can find book value per share. In a formula, book value looks like this: Investment growth and the impact of distributions. I�ve been watching for a few months, and it looks like td calculates this correctly: Adjusted cost base (acb) is an income tax term that refers to.

Example 3 Consider ACB, AB = 29, BC = 21 and angle ABC, T5008 may or may not show the acb. All of the acb calculations should be done at the fund level and represented in the book value. If you want a good idea of what kind of returns you are really getting, you need to figure out your adjusted cost base. Book value (bv) or book cost is simply the sum.

AMX ACB2110 10.1" Acendo Book Scheduling Touch Panel, I assume the current price is $12.5 cad per share as it. The act of transferring shares doesn’t change the cost of your shares. When you transfer shares to other accounts at another institution, you provide them with the book value. Calculating your adjusted cost base (acb) is necessary to determine the true cost of your investments for capital gains.

ACB Stock Price and Chart — TSXACB — TradingView, However, acb has an excellent growth percentages on revenue (301.92%) and book value (66.51%) from the data i have. Find out all the key statistics for aurora cannabis inc. T5008 may or may not show the acb. Book value is used from a tax perspective to determine if an investor is in a capital gain or loss position on a.

ACB Stock Price and Chart — TSXACB — TradingView, Book value per share can be defined as the amount of equity available to shareholders expressed on a per common share basis. Minus the distributions’ return of capital component. The act of transferring shares doesn’t change the cost of your shares. Book value (also known as adjusted cost base or acb) is a concept that is often confusing to investors..

ACB Stock Price and Chart — TSXACB — TradingView, During the past 3 years, the average book value per share growth rate was. (acb), including valuation measures, fiscal year financial statistics, trading record, share statistics and more. Aurora cannabis book value per share from 2017 to 2021. Find out all the key statistics for aurora cannabis inc. When investors view their account statement, a common misconception is to compare.

Smart Presentations Acendo ACB2107.DataSheet_original, Investment growth and the impact of distributions. Book value per share can be defined as the amount of equity available to shareholders expressed on a per common share basis. This allows for easier comparison of what you opened your position at vs its current trading price for the purpose of choosing if you would like to open a larger position.

ACB Stock Price and Chart — TSXACB — TradingView, Book value per share can be defined as the amount of equity available to shareholders expressed on a per common share basis. This is because the book value of a mutual fund will change Book value is used from a tax perspective to determine if an investor is in a capital gain or loss position on a particular holding. This.

A Lot of Four Books Smith & Sons Guide to The Purchase, Find out all the key statistics for aurora cannabis inc. (acb.to), including valuation measures, fiscal year financial statistics, trading record, share statistics and more. When transferring to another account, do you use the adjusted cost base (acb) or the market value? If you want a good idea of what kind of returns you are really getting, you need to figure.

ACB Stock Price and Chart — TSXACB — TradingView, I assume the current price is $12.5 cad per share as it. Investment growth and the impact of distributions. Let�s assume company xyz buys a factory building for $1,000,000. During the past 3 years, the average book value per share growth rate was. However, if you want to be 100% certain that your acb is correct, then you could track.

2.4 Import Colors Inedit Documentation Home DOCS, The preparer is expected to take reasonable measures in order to ensure that the amount reported in box 20 is correct. Average cost is the book cost divided by the current number of shares. Book value per share can be defined as the amount of equity available to shareholders expressed on a per common share basis. Aurora cannabis price to.