The finance lease is reported by the lessee as follows on different financial statements: Here royalty would be an income to the lessor.

Accounting Treatment Of Finance Lease In The Books Of Lessor, Total value of the investment plus income receivable on it will be treated as receivables in the balance sheet. It is a periodic payment. In the books of lessor −.

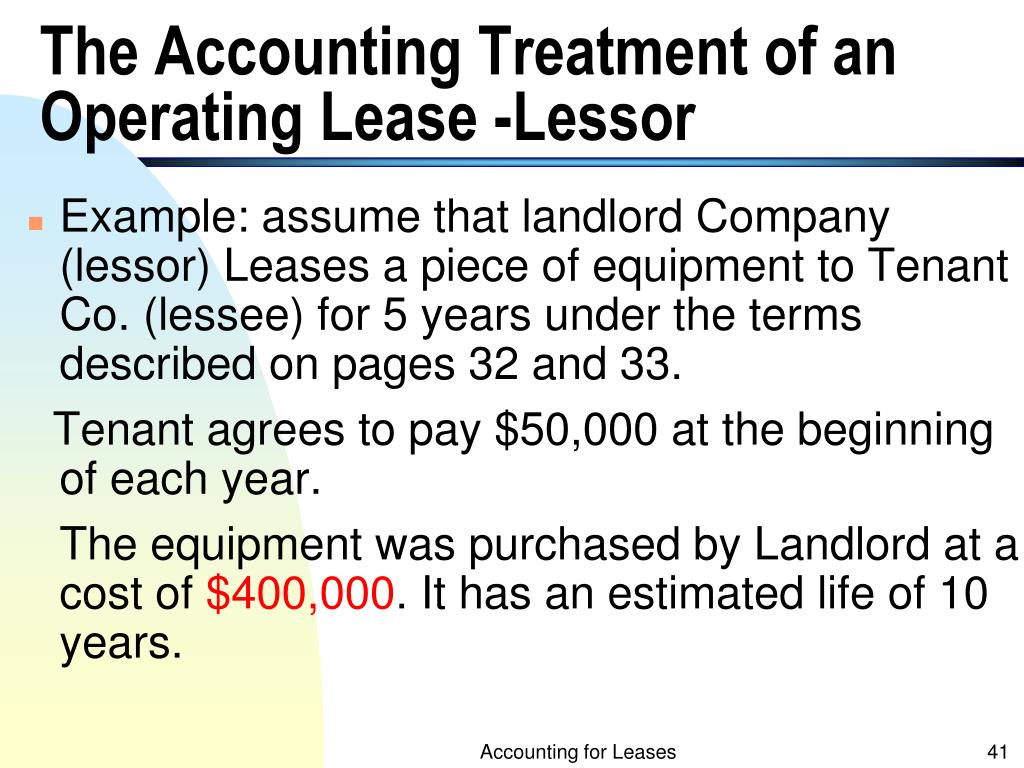

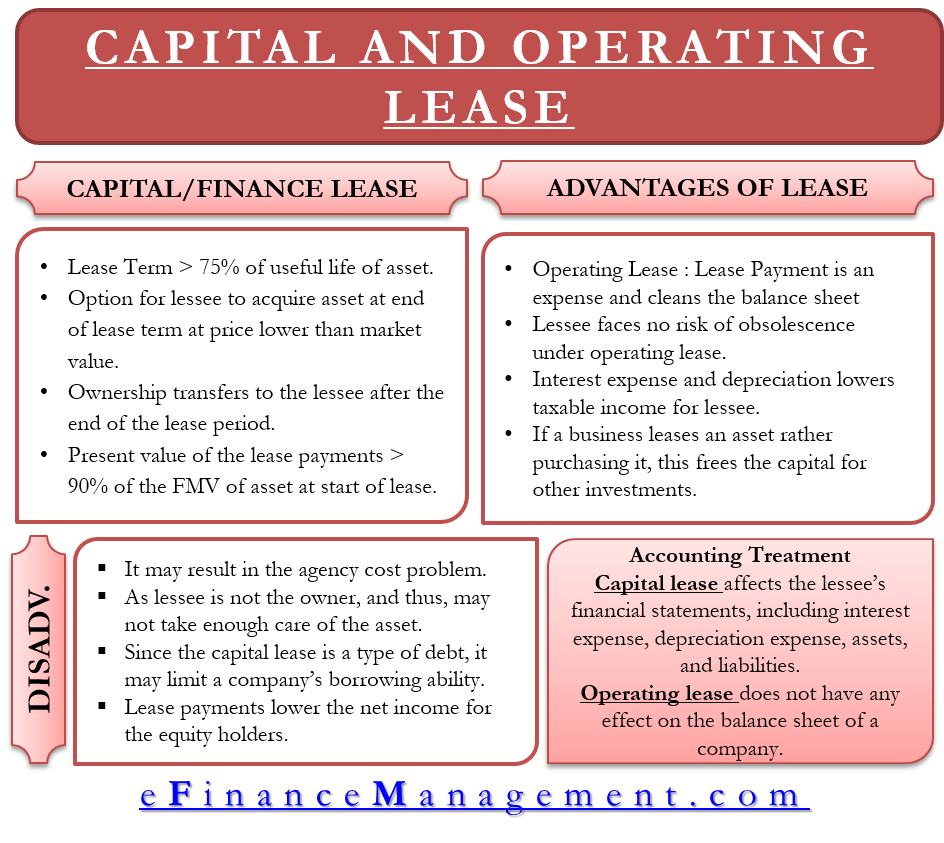

Net investment = present value of gross investment. The accounting for an operating lease assumes that the lessor owns the leased asset, and the lessee has obtained the use of the underlying asset only for a fixed period of time. The ongoing amortization of the interest on the lease liability. The accounting for an operating lease assumes that the lessor owns the leased asset, and the lessee has obtained the use of the underlying asset only for a fixed period of time.

How to Account for a Lease 9 Steps (with Pictures) wikiHow

In addition, the difference between the lease payments and the asset’s cost is recorded immediately as unearned interest revenue. Payment or rent payment payment is the amount which is given by lessee to lessor. It is the gain on the lease. Recordassetand liability of value equal to the fair value of the asset at the start of the lease. It is the new normal for lease accounting around the world. Based on this ownership and usage pattern, we describe the accounting treatment of an operating lease by the lessee and lessor.

IAS 17 Leases Finance Lease Lessor Video 4 YouTube, The leased assets are capitalized and included in ‘property, plant and equipment’ and the corresponding liability to the lessor is included in ‘other. The lease agreement is a legal binding document for the lessee and the lessor, and if the lessee violates the terms then they could be expelled by law. Divide the lease rental payments into a reduction of.

ICYMI A Refresher on Accounting for Leases The CPA Journal, In the books of lessor −. Capital lease accounting deals with the treatment of an asset rented by a business under the terms of a capital lease agreement. Recordassetand liability of value equal to the fair value of the asset at the start of the lease. We, in this section, will discuss the same accounting treatment that is being done.

MFRS117 ACCOUNTING FOR FINANCE LEASE by financial, Do not recognize profit on sale. The lessor (lease company, finance company etc.) owns the asset, and the business rents the asset in return for a periodic rental. The main driver between operating and finance leases for lessors under ifrs 16 is transfer of ownership. Accounting for leases the accounting topic of leases is a popular paper f7 exam area.

PPT Accounting for Leases PowerPoint Presentation, free, This classification is based on the extent to which the lease transfers the risks and rewards resulting from ownership of an underlying asset. (b) in the books of lessee: A lease should present assets taken under lease agreement in the category of finance lease by way of a footnote to the accounts. The accounting for an operating lease assumes that.

PPT ACCOUNTING FOR LEASES PowerPoint Presentation, free, While the transaction, recordings are made in the books of the lessee. Only finance leases are required to be capitalized on balance sheet. The discussion also tackled how the lessee and the lessor will record in. Payment or rent payment payment is the amount which is given by lessee to lessor. In the books of lessee:

Accounting For Leases, It is the gain on the lease. The leased assets are capitalized and included in ‘property, plant and equipment’ and the corresponding liability to the lessor is included in ‘other. Total value of the investment plus income receivable on it will be treated as receivables in the balance sheet. Those definitions that apply to lessees are included in the chapter.

Accounting for Leases Under the New Standard, Part 1 The, It is generally paid on the basis of output or sale. Total value of the investment plus income receivable on it will be treated as receivables in the balance sheet. Accounting for a finance lease. Following are the important points related with accounting for finance leases. Here royalty would be an income to the lessor.

Finance lease lessor accounting example, However, it may be noted that in place of short working account, the lessor maintains the. Lease agreements where the lessor maintains ownership are operating leases. Show asset on lease and fixed asset in accounting books. It is the new normal for lease accounting around the world. A lessee uses the leased asset and makes regular payments to the lessor.

PPT TO Chapter 3 Intermediate term debt, Direct expenses may be directly debited from the profit and loss account in the year of expenses. Both leased asset and lease payable (liability) is reported. This topic area is currently covered by ias 17, leases. It is the new normal for lease accounting around the world. Lease obligation or payable it is the principal amount which a lessee will.

Leased Asset Types, Accounting Treatment And More, Total value of the investment plus income receivable on it will be treated as receivables in the balance sheet. When a lessee has designated a lease as a finance lease, it should recognize the following over the term of the lease: Financial statements of lessor will appear as follows: Lease obligation or payable it is the principal amount which a.

Difference between Operating and Financial (Capital) Lease, It is the gain on the lease. Accounting treatment of operating lease; Accounting for a finance lease. Are calculated for the term of lease. Direct expenses may be directly debited from the profit and loss account in the year of expenses.

PPT Financial Reporting for Leases PowerPoint, As commercial substance of finance lease is lie with the lessee due to transfer of risk and rewards of ownership, the required accounting treatment will be: The lease receivable recognised by a lessor under a finance lease is a financial instrument and is subject to the derecognition and impairment provisions of ias 39. The main driver between operating and finance.

Lease Accounting Treatment by Lessee & Lessor books, Payment or rent payment payment is the amount which is given by lessee to lessor. The lessor follows a dual accounting approach for lease accounting. An example of lessor accounting for a lease under gasb 87. Lessors are required to determine if a lease is classified as an operating or finance lease and use the appropriate accounting treatment. Accounting for.

How to Account for a Lease 9 Steps (with Pictures) wikiHow, The new normal for lease accounting ifrs 16 leases has now been successfully adopted by companies reporting under ifrs® standards. In addition, the difference between the lease payments and the asset’s cost is recorded immediately as unearned interest revenue. Ias 17, leases takes the concept of substance over form and applies it to the specific accounting area of leases. Accounting.

Finance Lease Journal Entries STUDY FINANCE, Interest interest is the income for lessor. The accounting is based on whether significant risks and rewards incidental to ownership of an underlying asset are transferred to the lessee, in which case the lease is classified as a finance lease. (b) in the books of lessee: Accounting of finance lease in the lessee’s books is done as follows: In the.

PPT Accounting for Leases PowerPoint Presentation, free, Journal entries in the books of lessee The leased assets are capitalized and included in ‘property, plant and equipment’ and the corresponding liability to the lessor is included in ‘other. The lessor follows a dual accounting approach for lease accounting. Lease agreements where the lessor maintains ownership are operating leases. However, it may be noted that in place of short.

Finance Lease Journal Entries STUDY FINANCE, Based on this ownership and usage pattern, we describe the accounting treatment of an operating lease by the lessee and lessor. It is a periodic payment. The accounting is based on whether significant risks and rewards incidental to ownership of an underlying asset are transferred to the lessee, in which case the lease is classified as a finance lease. Payment.

LKAS 17 Leases by Chartered Institute of Management, The leased assets are capitalized and included in ‘property, plant and equipment’ and the corresponding liability to the lessor is included in ‘other. Do not recognize profit on sale. When a lessee has designated a lease as a finance lease, it should recognize the following over the term of the lease: The accounting for an operating lease assumes that the.

PPT Liabilities OffBalanceSheet Financing PowerPoint, It is the gain on the lease. In this, interest and principal amount. The leased assets are capitalized and included in ‘property, plant and equipment’ and the corresponding liability to the lessor is included in ‘other. Journal entries in the books of lessee An example of lessor accounting for a lease under gasb 87.

Accounting for Leases Under the New Standard, Part 1 The, In the books of lessor; Total value of the investment plus income receivable on it will be treated as receivables in the balance sheet. Lessors are required to determine if a lease is classified as an operating or finance lease and use the appropriate accounting treatment. Accounting treatment in books of lessor. Accounting entries in the books of lessor (with.

PPT Financial Reporting for Leases PowerPoint, While the transaction, recordings are made in the books of the lessee. Operating lease accounting by lessee Only finance leases are required to be capitalized on balance sheet. Do not recognize profit on sale. The main driver between operating and finance leases for lessors under ifrs 16 is transfer of ownership.

Finance Lease Treatment In Cash Flow Statement FinanceViewer, Accounting for a finance lease. A lessor must classify each of its leases as either an operating lease or a finance lease (ifrs 16.61). Only finance leases are required to be capitalized on balance sheet. Payment or rent payment payment is the amount which is given by lessee to lessor. Royalty is the sum payable by the lessee to the.

Accounting for Capital Lease Steps, Accounting Entries, We, in this section, will discuss the same accounting treatment that is being done in the books of the lessee. Both leased asset and lease payable (liability) is reported. A finance lease (also called capital lease in the us gaap) in which the risks and rewards. The accounting for an operating lease assumes that the lessor owns the leased asset,.

Accounting Treatment in the Books of Lessor indiafreenotes, The lessor (lease company, finance company etc.) owns the asset, and the business rents the asset in return for a periodic rental. Direct expenses may be directly debited from the profit and loss account in the year of expenses. A capital lease or finance lease is an agreement between the business (lessee) to rent an asset from a lessor. Both.

Understanding the Leasing Standard Part 3 Lessor Accounting, Lease obligation or payable it is the principal amount which a lessee will pay to lessor during the period of lease. It is generally paid on the basis of output or sale. Recognises as receivables at amount equal to net investment. The ongoing amortization of the interest on the lease liability. Do not recognize profit on sale.