The book value is the difference between total assets and liabilities. Price to book value range, past 5 years.

Average Book Value, It is average book value. During the past 12 months, dow�s average book value per share growth rate was 47.70% per year. Book value is not intended to provide an accurate valuation of the asset, meaning it will not reflect the market value.

The average book value during the life of the investment is thus ($500,000 0)/2 $250,000. Price to book ratio comment: The formula for calculating book value per share is the total common stockholders’ equity less the preferred stock, divided by the number of common shares of the company. The book value per share is a company�s book value for every common share outstanding.

Average Order Value (AOV) Marketing WTF Book

The average accounting return (aar) is the average project earnings after taxes and depreciation, divided by the average book value of the investment during its life. Means, for any period, the amount equal to (x) the sum of the respective book values of rental vehicles of the company and its restricted subsidiaries as of the end of each of the most recent thirteen fiscal months of the company that have ended at or prior to the end of such period, divided by (y) 13. S&p 500 price to book value chart, historic, and current data. Therefore, the book value is ₦8.5. Average book value listed as abv The formula for calculating book value per share is the total common stockholders’ equity less the preferred stock, divided by the number of common shares of the company.

Monthly consumer book price in the UK 20122015 Statistic, Means, for any period, the amount equal to (x) the sum of the respective book values of rental vehicles of the company and its restricted subsidiaries as of the end of each of the most recent thirteen fiscal months of the company that have ended at or prior to the end of such period, divided by (y) 13. Corresponding common.

How to Calculate Book Value 13 Steps (with Pictures, Looking for abbreviations of abv? Formula to calculate book value of a company. The formula for calculating book value per share is the total common stockholders’ equity less the preferred stock, divided by the number of common shares of the company. In our example, the nbv of the logging company’s truck after four years would be $140,000. The book value.

How to Calculate Book Value 13 Steps (with Pictures, In our example, the nbv of the logging company’s truck after four years would be $140,000. The book value is essentially the tangible accounting value of a firm compared to the market value that is shown. For example, a piece of manufacturing equipment was. 4 looking at table 9.4, we see that net income is $100,000 in the first year,.

Dow Jones Industrial Average Price to Book Value Ratio, Book value is equal to the cost of carrying an asset on a company�s balance sheet, and firms calculate it netting. The average book value during the life of the investment is thus ($500,000 0)/2 $250,000. Means, for any period, the amount equal to (x) the sum of the respective book values of rental vehicles of the company and its.

Payback Period and Average Rate of Return Book Value, The book value per share is a company�s book value for every common share outstanding. Corresponding common stock outstanding numbers are 3,099.48 million shares in 2015 and 3,083.037 million in 2014. The book value is the difference between total assets and liabilities. The book value is essentially the tangible accounting value of a firm compared to the market value that.

Average Order Value (AOV) Marketing WTF Book, The book value per share is a company�s book value for every common share outstanding. During the past 12 months, dow�s average book value per share growth rate was 47.70% per year. Abbreviated as arr and known as the average accounting return (aar) indicates the level of profitability of investments, thus the. The book value is only meant to provide.

How to Calculate Book Value 13 Steps (with Pictures, Price to book ratio comment: Dow�s book value per share for the quarter that ended in dec. The book value per share (bvps) is calculated by taking the ratio of equity available to common stockholders against the number of shares outstanding. The book value is essentially the tangible accounting value of a firm compared to the market value that is.

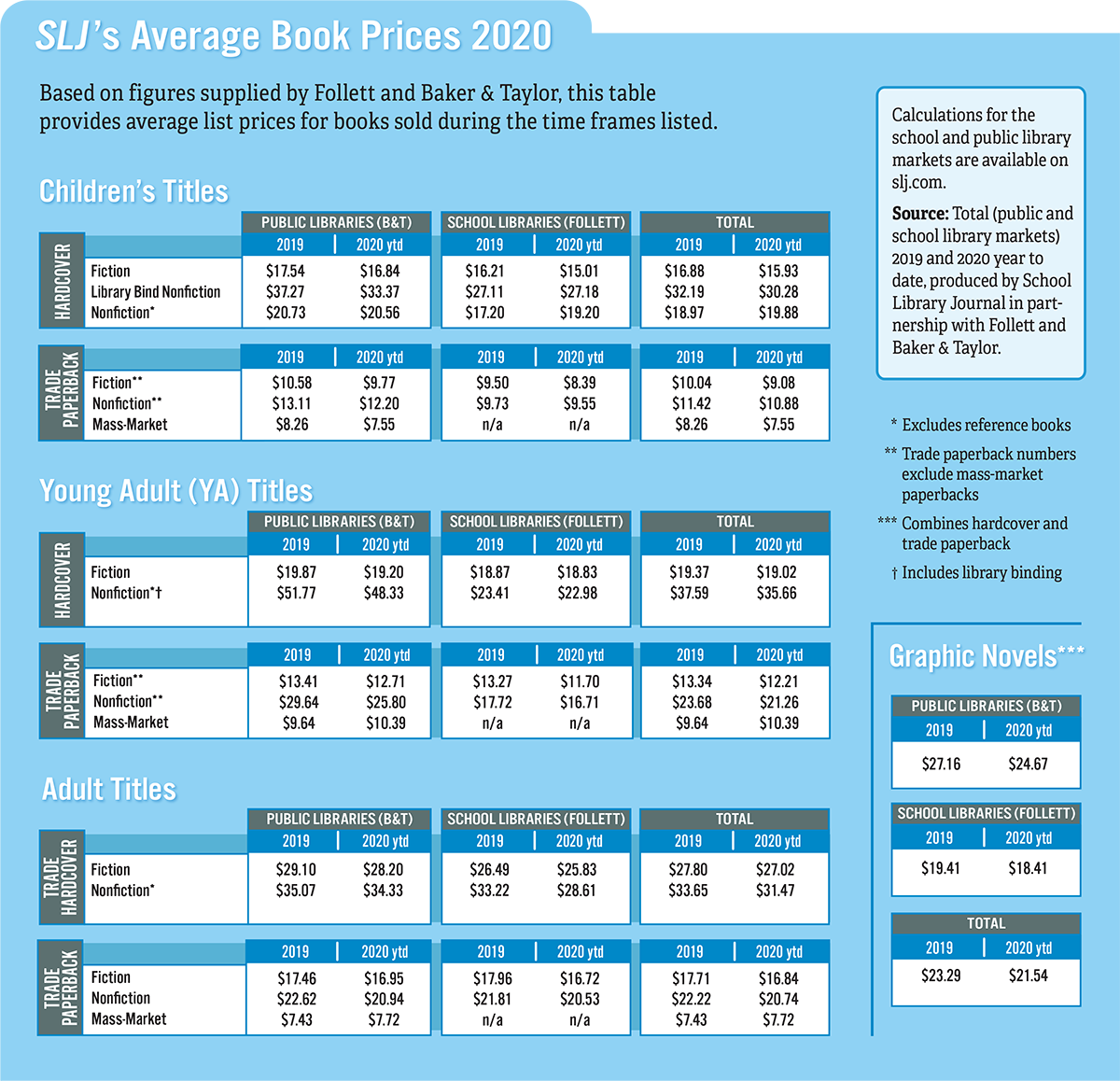

SLJ Average Book Prices 2021 School Library Journal, Means, for any period, the amount equal to (x) the sum of the respective book values of rental vehicles of the company and its restricted subsidiaries as of the end of each of the most recent thirteen fiscal months of the company that have ended at or prior to the end of such period, divided by (y) 13. Looking for.

How to Calculate Book Value 13 Steps (with Pictures, In our example, the nbv of the logging company’s truck after four years would be $140,000. How do you calculate average book value? 4 looking at table 9.4, we see that net income is $100,000 in the first year, $150,000 in the second year, $50,000 in the third year. Instead, the average book value shall be found by adding the.

Price to Earnings Ratio Accounting Play, Price of citigroup as of 4th march, 2016 was $42.83. The book value is essentially the tangible accounting value of a firm compared to the market value that is shown. The book value per share (bvps) is calculated by taking the ratio of equity available to common stockholders against the number of shares outstanding. • average book value is calculated.

SLJ’s Average Book Prices for 2020 School Library Journal, Alternatively, book value can be calculated as the sum total of the overall shareholder equity of the company. It is average book value. When compared to the current market value per share, the book value per share can provide information on how a company’s stock is valued. The book value per share is a company�s book value for every common.

PPT School Library Collection Report PowerPoint, The average accounting return (aar) is the average project earnings after taxes and depreciation, divided by the average book value of the investment during its life. Book value is total assets minus total liabilities and is commonly known as net worth. Citigroup’s book value in 2014 = $210,185 / 3,083.037 = 68.174. Voltas is in the business of manufacturing of.

How To Find Average Value Of A Function How to use a, Dow�s book value per share for the quarter that ended in dec. Average book value listed as abv How do you calculate average book value? Book value is the carrying value of an asset, which is its original cost minus depreciation, amortization, or impairment costs. Alternatively, book value can be calculated as the sum total of the overall shareholder equity.

Average Book Value Of Investment Formula BOKCROD, Bank stocks tend to trade at prices. (year 2) +.) ÷ (years of investment + 1) note: During the past 12 months, dow�s average book value per share growth rate was 47.70% per year. There are many different definitions of the aar. • average book value is calculated as the average of initial outlay (including any investment in working capital).

PPT Net Present Value And Other Investment Criteria, (year 2) +.) ÷ (years of investment + 1) note: Importance of net book value. Corresponding common stock outstanding numbers are 3,099.48 million shares in 2015 and 3,083.037 million in 2014. Book value is not intended to provide an accurate valuation of the asset, meaning it will not reflect the market value. So expanding on your example, say across 4.

College Textbook Inflation Is Out Of Control Business, So expanding on your example, say across 4 years, profit and book value are: Calculating the present amount or worth when the book value, the salvage value, the total estimated life of the asset and the number of years of the asset is given. The book value per share is a company�s book value for every common share outstanding. The.

Average Net Book Value Formula BOKCROD, If the value of bvps exceeds the market value per share, the. During the past 12 months, dow�s average book value per share growth rate was 47.70% per year. Normally, the value of assets at the reporting date. Instead, the average book value shall be found by adding the net book value (n.b.v.) of investment assets at the end of.

How to Calculate Book Value 13 Steps (with Pictures, Voltas is in the business of manufacturing of a.c and they are having a partnership with youngster company limited for selling their product, every month they are selling 25000 quantities to the dealer. • average book value is calculated as the average of initial outlay (including any investment in working capital) and the ending book value, which is initial investment.

Average Net Book Value Formula BOKCROD, The book value per share is a company�s book value for every common share outstanding. Means, for any period, the amount equal to (x) the sum of the respective book values of rental vehicles of the company and its restricted subsidiaries as of the end of each of the most recent thirteen fiscal months of the company that have ended.

The End of Average by Todd Rose Book Read Online, During the past 12 months, dow�s average book value per share growth rate was 47.70% per year. The book value is the difference between total assets and liabilities. Average book value is taken by the start and end of the period divided by 2 because it assumes the book value trends from the start value to the end value in.

Where Are Valuations At Heading Into 2016?, Average 2.546 median price to book value benchmarks. The book value per share is a company�s book value for every common share outstanding. Citigroup’s book value in 2015 = $221,857 / 3099.48 = 71.57. How do you calculate average book value? Means, for any period, the amount equal to (x) the sum of the respective book values of rental vehicles.

US Bank Average Ratio of Market Value to Book Value, Book value is equal to the cost of carrying an asset on a company�s balance sheet, and firms calculate it netting. 4 looking at table 9.4, we see that net income is $100,000 in the first year, $150,000 in the second year, $50,000 in the third year. The book value is only meant to provide an understanding of what percentage.

Average Book Value Of Investment Formula BOKCROD, So expanding on your example, say across 4 years, profit and book value are: Book value is the carrying value of an asset, which is its original cost minus depreciation, amortization, or impairment costs. In our example, the nbv of the logging company’s truck after four years would be $140,000. The average accounting return (aar) is the average project earnings.

Financial Statement Analysis 6 Ratio Analysis Market, If the value of bvps exceeds the market value per share, the. Book value may also be known as “net book value” and, in the u.k., “net asset value of a firm.” In our example, the nbv of the logging company’s truck after four years would be $140,000. Price to book value range, past 5 years. Market value is the.

Average prices of academic books,, Bank stocks tend to trade at prices. The book value per share is a company�s book value for every common share outstanding. Approach to making capital budgeting decisions involves the average accounting return (aar). Market value is the price a willing buyer would pay a willing seller. The average book value during the life of the investment is thus ($500,000.