6 years from the due date of furnishing of annual return for the year pertaining to such accounts and records. Every mortgage lender or mortgage broker required to be licensed under this chapter shall maintain in its offices such books, accounts, and records as the commission may reasonably require in order to determine whether such person is complying with the provisions of this chapter and regulations adopted hereunder.

Retention Of Books Of Accounts, When an account receivable is collected 30 days later, the asset account accounts receivable is reduced and the asset account cash is increased. As required under section 44aa or the rules framed thereunder. Retention of accounting records and other corporate records purchase invoices and supplier documentation document retention period reason for retention period payments cash book or record of payments made six years from the end of the financial year in which the transaction was made companies act/charities act 1

Every mortgage lender or mortgage broker required to be licensed under this chapter shall maintain in its offices such books, accounts, and records as the commission may reasonably require in order to determine whether such person is complying with the provisions of this chapter and regulations adopted hereunder. As required under section 44aa or the rules framed thereunder. Every registered dealer must preserve all books of account, registers and other documents pertaining to stocks, purchases, dispatches and deliveries of goods, payment made and receipts towards sale or purchase of goods for a period of not less than 8 years from the expiry of the year to which they relate. Every registered dealer must preserve all books of account, registers and other documents pertaining to stocks, purchases, dispatches and deliveries of goods, payment made and receipts towards sale or purchase of goods for a period of not less than 8 years from the expiry of the year to which they relate.

Summary “Retention of Accounting Records A Global

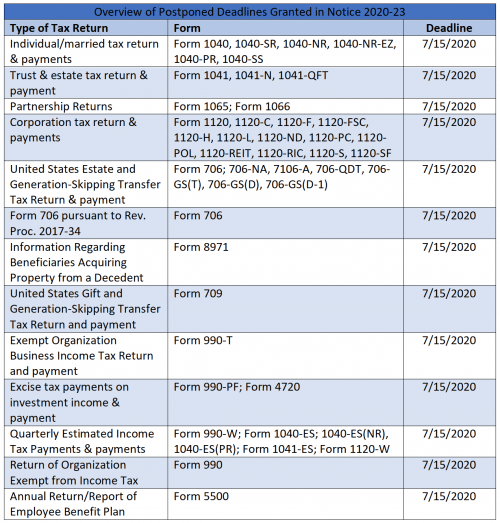

Or if filed after the deadline, from the date of the filing of the return, for the taxable year when the last entry was made in the books of accounts: When the retention is paid, raise another sales invoice using the remaining receipt. 6 years from the due date of furnishing of annual return for the year pertaining to such accounts and records. Retention of accounting records and other corporate records purchase invoices and supplier documentation document retention period reason for retention period payments cash book or record of payments made six years from the end of the financial year in which the transaction was made companies act/charities act 1 On the customer receipt tab, select the required customer account. No rule provides for the period of retention of the books by the person carrying on the business.

Record Retention How long should I keep my tax, The period will be counted from the last date of filing of annual return for that year. Section 271a provides for penalty for failure to keep, maintain or retain books of account, documents, etc. For how long does a company have to store its accounting books and records? Or (2) photographic, electronic, or other. Retention of books, accounts, and records.

Maintain Books of Accounts with or without Inventory in, Section 271a provides for penalty for failure to keep, maintain or retain books of account, documents, etc. Retention of books, accounts and records. Books and records must be supported by source documents which substantiate the amounts in the books of account. Retention period of boa taxpayers are required to keep their business records for ten (10) years counted from the.

QuickBooks For Contractors Retention and The Cash Basis, Cash book journal ledger carbon copies of bills original bills issued to a person or receipt in case of expenditure daily case register having details of patients, services rendered, fees receipt and date of receipt (persons carrying on medical profession) Or if filed after the deadline, from the date of the filing of the return, for the taxable year when.

II. RECORD RETENTION Record Keeping Requirements for, Cash book journal ledger carbon copies of bills original bills issued to a person or receipt in case of expenditure daily case register having details of patients, services rendered, fees receipt and date of receipt (persons carrying on medical profession) Every licensee shall maintain in its principal place of business such books, accounts, and records as the commission may reasonably.

The Keys To Effective Employee Retention Business by the, The retention will be the current asset for the contractor as it is to be received from the contractee in near future and it will be current liability to the contractee as it is to be paid to the contractor after successful completion of the projects or contracts. As per the gst act, every registered taxable person must maintain the.

Summary “Retention of Accounting Records A Global, As per the gst act, every registered taxable person must maintain the accounts books and records for at least 72 months (6 years). The following are considered to be primary documentation: (2) makes the books, accounts, and records available at a location in the state, as agreed by the commissioner and the licensee, within 7 days after a written request.

The Proper Way To Practice Semen Retention (Ebook, Every licensee shall maintain in its principal place of business such books, accounts, and records as the commission may reasonably require in order to determine whether such licensee is complying with the provisions of this chapter and other laws applicable to the. More commonly, retention of accounting records is addressed in a commercial code, which regulates the activities of commercial.

Retention and Payment Essentials of Being Retained and, Every licensee shall maintain in its approved offices such books, accounts and records as the commission may reasonably require in order to determine whether such licensee is complying with the provisions of this chapter and regulations adopted in furtherance thereof. The following are considered to be primary documentation: Retention of books, accounts and records. In the books of contracataor. Every.

Retention of Books of Accounts Five Years or Ten Years, On the customer receipt tab, select the required customer account. That the rules specified the period for which the books of account are to be retained by the certain professionals. When the retention is paid, raise another sales invoice using the remaining receipt. Retention is the part of every billing to be withheld till the specific period. Vouchers which form.

SAP Retention Process SAP Blogs, In the books of contracataor. Retention of books, accounts and records. The following are considered to be primary documentation: Therefore, the assessee who is carrying on the business cannot be penalised under s. Purchases returns book is a book in which the goods returned to suppliers are recorded.

Always up to date globally with the global data retention, “all taxpayers are required to preserve their books of accounts, including subsidiary books and other accounting records, for a period of ten (10) years reckoned from the day following the deadline in filing a return, or if filed after the deadline, from the date of filing of the return, for the taxable year when the last entry was made on.

The Proper Way To Practice Semen Retention (Ebook, Purchases returns book is a book in which the goods returned to suppliers are recorded. The retention will be the current asset for the contractor as it is to be received from the contractee in near future and it will be current liability to the contractee as it is to be paid to the contractor after successful completion of the.

The Best Practices in Document Retention Time as per GDP., Act that specifies retention periods for accounting records. Retention of books of accounts hitendra hasmukhlal mehta (proprietor of h h m & Or (2) photographic, electronic, or other. Cash book journal ledger carbon copies of bills original bills issued to a person or receipt in case of expenditure daily case register having details of patients, services rendered, fees receipt and.

Retention Strategies A Complete Guide 2019 Edition, More commonly, retention of accounting records is addressed in a commercial code, which regulates the activities of commercial enterprises, or a company law, which specifies recordkeeping requirements to protect the interests of shareholders, partners, or other stakeholders. Or if filed after the deadline, from the date of the filing of the return, for the taxable year when the last entry.

Employee Record Retention For Your Business The Complete, Or if filed after the deadline, from the date of the filing of the return, for the taxable year when the last entry was made in the books of accounts: (2) makes the books, accounts, and records available at a location in the state, as agreed by the commissioner and the licensee, within 7 days after a written request for.

BLOG Employee Retention Credit Could Help Your Business, What is the period of retention of books of accounts mentioned above? More commonly, retention of accounting records is addressed in a commercial code, which regulates the activities of commercial enterprises, or a company law, which specifies recordkeeping requirements to protect the interests of shareholders, partners, or other stakeholders. The following are considered to be primary documentation: Canada revenue agency.

Records Retention Schedule Form Accounts Payable, Therefore, the assessee who is carrying on the business cannot be penalised under s. (c) form of retained materials. The following are considered to be primary documentation: Section 271a provides for penalty for failure to keep, maintain or retain books of account, documents, etc. Purchases returns book is a book in which the goods returned to suppliers are recorded.

SAP Retention Process SAP Blogs, Canada revenue agency (cra) indicates that supporting documents for the income tax return of an individual should be kept for. The books of account and other documents are required to be maintained : Retention is the part of every billing to be withheld till the specific period. Every licensee shall maintain in its principal place of business such books, accounts,.

Figure 2 from Management of Acute and Chronic Retention in, Therefore, the assessee who is carrying on the business cannot be penalised under s. It is also called returns outward book or purchases returns day book. Retention period of boa taxpayers are required to keep their business records for ten (10) years counted from the day after the deadline in filing the return, or in cases of late filing, from.

Building your record retention policy for your business, Every registered dealer must preserve all books of account, registers and other documents pertaining to stocks, purchases, dispatches and deliveries of goods, payment made and receipts towards sale or purchase of goods for a period of not less than 8 years from the expiry of the year to which they relate. On the customer receipt tab, select the required customer.

Cost Accounting SYBAF Semester III Manan Prakashan The, What is the period of retention of books of accounts mentioned above? Purchases returns book is a book in which the goods returned to suppliers are recorded. Or if filed after the deadline, from the date of the filing of the return, for the taxable year when the last entry was made in the books of accounts: The books of.

How do I set up a retention account in Quickbooks Online?, Retention is the part of every billing to be withheld till the specific period. What is the period of retention of books of accounts mentioned above? Books and records must be supported by source documents which substantiate the amounts in the books of account. 6 years from the due date of furnishing of annual return for the year pertaining to.

Retention of Books of Accounts Five Years or Ten Years, Every licensee shall maintain in its approved offices such books, accounts and records as the commission may reasonably require in order to determine whether such licensee is complying with the provisions of this chapter and regulations adopted in furtherance thereof. (c) form of retained materials. Retention of books of accounts hitendra hasmukhlal mehta (proprietor of h h m & Or.

Retention of Books of Accounts Five Years or Ten Years, Retention of books, accounts, and records. Vouchers which form a basis for the actual bookkeeping (incoming and outgoing invoices, cash book balances, bank vouchers, salary. The following are considered to be primary documentation: Select the relevant bank account and enter the following information: Retention of books of accounts hitendra hasmukhlal mehta (proprietor of h h m &

10 Ways to Increase Customer Retention to Scale Your, Retention period of boa taxpayers are required to keep their business records for ten (10) years counted from the day after the deadline in filing the return, or in cases of late filing, from the filing date for the year, when the last entry was made in the books of accounts: In the books of contracataor. On the customer receipt.